The following 32 chapters are used in this document: Cover Letter, Title Page, Table of Contents, Non-Disclosure Form (Short Version), Introduction, Executive Summary, Mergers, Project Background, Goals and Objectives, Opportunities, Future Potential, Risk Analysis, Management, Procedures, Time Line, Legal Considerations, Consolidation, Entities Affected, Organizational Structure, Facilities, Company Operations, Programs and Activities, Shareholders, Workforce, Subsidiaries, Officers and Board, Financial Information, Capital, Cost/Benefit Analysis, Summary, Recommendations, Back Page

How to write your Merger of Companies Proposal

We include this 32 page layout with Proposal Pack. Create variations of this document of any length to suit your specific needs—Order and download for $79.

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES

You can also create countless variations of this document to suit your needs using the included library of 2200+ chapters.

What Our Clients Say

What Our Clients SayI have been using Proposal Pack for 4 years and I love it. It makes proposal writing fun and easy. I like the professional look it provides and my prospects turn in to clients."

Bottom Line Enterprises

---

Components of a Merger of Companies Proposal

There is no one-size-fits-all template for a merger of companies proposal. Proposal Kit templates can be customized as needed to fit any situation using the extensive chapter template library. Here are some key chapters typically included in this type of template. Use this template as your starting point and customize it as needed using the software included with each Proposal Pack or the Professional bundle.

Cover Letter

This chapter serves as the introductory page of the proposal, presenting a brief overview of the purpose of the document and extending a welcome to the reader. When used in a merger, it addresses the decision-makers of the merging entities, providing a formal yet inviting introduction to the proposal's content.

Non-Disclosure Form (Short Version)

This chapter includes a legal form ensuring confidentiality. It is used to protect sensitive information exchanged between the companies during the merger discussions, establishing trust and legal boundaries from the outset.

Introduction

The introduction chapter outlines the basic premise of the merger proposal. It briefly describes the purpose of the merger, the companies involved, and sets the stage for the detailed chapters that follow.

Executive Summary

This chapter provides a high-level overview of the entire proposal. It summarizes the key points, including the rationale for the merger, anticipated benefits, and goals. This section is crucial for executives needing a quick grasp of the proposal's highlights.

Opportunities

The opportunities chapter identifies and discusses the potential benefits and new prospects that the merger would create. This includes market expansion, resource optimization, and improved competitive positioning.

Goals and Objectives

This chapter details the specific goals and objectives the merger aims to achieve. It outlines measurable outcomes such as increased market share, cost savings, and improved operational efficiencies.

Procedures

The procedures chapter describes the step-by-step processes that will be followed to complete the merger. It includes timelines, key milestones, and necessary actions to ensure smooth integration.

Management

This chapter focuses on the management structure post-merger. It explains how the leadership teams from both companies will be integrated and who will be responsible for overseeing the merger process.

Risk Analysis

In this chapter, potential risks associated with the merger are identified and analyzed. It covers financial, operational, and market risks, along with strategies to mitigate these risks.

Consolidation

This chapter outlines how the merging companies will consolidate their operations, assets, and resources. It includes plans for combining departments, systems, and business processes.

Project Background

The project background chapter provides historical context and relevant background information about the merging companies. It highlights past achievements, market presence, and previous collaborations if any.

Mergers

This chapter explores the concept of mergers in general and provides specific case studies or examples related to the proposed merger. It helps contextualize the current proposal within broader industry trends.

Time Line

This chapter presents a detailed timeline for the merger process. It includes key dates, phases of implementation, and expected completion times for various activities.

Legal Considerations

This chapter lays out the legal aspects of the merger. It covers regulatory requirements, compliance issues, and any legal hurdles that must be addressed during the merger process.

Entities Affected

In this chapter, all stakeholders impacted by the merger are listed. This includes employees, customers, suppliers, and partners, along with a discussion on how they will be affected.

Financial Information

This chapter provides detailed financial data related to the merger. It includes current financial statements of both companies, projected financial outcomes post-merger, and funding requirements.

Capital

The capital chapter discusses the financial resources needed for the merger. It covers sources of capital, investment requirements, and financial strategies to support the merger.

Cost/Benefit Analysis

This chapter presents a detailed analysis of the costs involved in the merger versus the anticipated benefits. It helps stakeholders understand the financial trade-offs and overall value proposition.

Recommendations

In this chapter, specific recommendations are made regarding the merger. It includes suggestions based on the analysis provided in the previous chapters to ensure a successful merger.

Summary

The summary chapter revisits the key points of the proposal, encapsulating the main arguments and benefits of the merger. It serves as a final recap for decision-makers.

Future Potential

This chapter looks ahead to the long-term potential of the merged entity. It discusses future growth opportunities, market expansion plans, and initiatives that could be pursued post-merger.

Facilities

This chapter addresses the physical assets involved in the merger. It includes plans for consolidating or relocating office spaces, factories, and other facilities.

Company Operations

This chapter examines how daily operations will be affected by the merger. It covers changes in workflows, operational procedures, and systems integration.

Programs and Activities

This chapter outlines existing and planned programs and activities that will be impacted by the merger. It discusses how these programs will be integrated and any new initiatives that will be launched.

Shareholders

The shareholders chapter focuses on the impact of the merger on the shareholders of both companies. It includes information on share distribution, voting rights, and dividend policies.

Workforce

This chapter discusses the implications of the merger on employees. It covers staffing changes, employee benefits, and strategies for managing workforce integration.

Subsidiaries

The subsidiaries chapter details how any subsidiary companies will be affected by the merger. It outlines plans for integrating or restructuring these entities.

Officers and Board

This chapter describes changes to the executive officers and board of directors resulting from the merger. It includes information on new appointments and governance structures.

Organizational Structure

This chapter provides a detailed view of the new organizational structure post-merger. It includes organizational charts and descriptions of new roles and reporting lines.

Examples of projects a Merger of Companies Proposal may be used for

This document can be used in many contexts and has various uses depending on the needs. Depending on your situation, customize the chapter list as needed using a Proposal Pack or the Professional bundle.

- To present a formal proposal for the merger of two companies.

- To outline the benefits of merging two businesses.

- To provide detailed financial analysis supporting the merger.

- To explain the legal considerations involved in the merger.

- To communicate the operational changes resulting from the merger.

- To detail the integration plan for management and staff.

- To reassure stakeholders about the confidentiality of the merger discussions.

- To highlight the future growth potential of the merged entity.

- To define the timeline and key milestones for the merger process.

- To describe how physical assets and facilities will be managed post-merger.

- To analyze the risks and propose mitigation strategies.

- To summarize the overall goals and objectives of the proposed merger.

- To recommend specific actions for successful merger implementation.

- To explain the impact on shareholders and their benefits.

- To discuss the integration of existing programs and activities.

- To detail how subsidiary companies will be affected.

- To present a new organizational structure post-merger.

- To provide background information and historical context for the merger.

- To delineate the new roles and responsibilities for the board and officers.

- To outline the capital requirements and sources for funding the merger.

Related To

The Merger of Companies Proposal may also be referred to in different ways or be used in more specialized situations, such as:

- Business Integration

- Company Consolidation

- Corporate Merger

- Strategic Alliance

- Financial Merger

- Business Unification

- Corporate Acquisition

- Organizational Integration

- Merger Strategy

- Company Synergy

4.7 stars, based on 842 reviews

4.7 stars, based on 842 reviewsChapter Templates Used in the Merger of Companies Proposal

Cover Letter, Title Page, Table of Contents, Non-Disclosure Form (Short Version), Introduction, Executive Summary, Opportunities, Goals and Objectives, Procedures, Management, Risk Analysis, Consolidation, Project Background, Mergers, Time Line, Legal Considerations, Entities Affected, Financial Information, Capital, Cost/Benefit Analysis, Recommendations, Summary, Future Potential, Facilities, Company Operations, Programs and Activities, Shareholders, Workforce, Subsidiaries, Officers and Board, Organizational Structure, Back Page

You use this this proposal for

- General business proposal

- Non-technical proposal

- Internal company proposal

- Business opportunity, partnership proposal

How to create the Merger of Companies Proposal with Proposal Pack Wizard

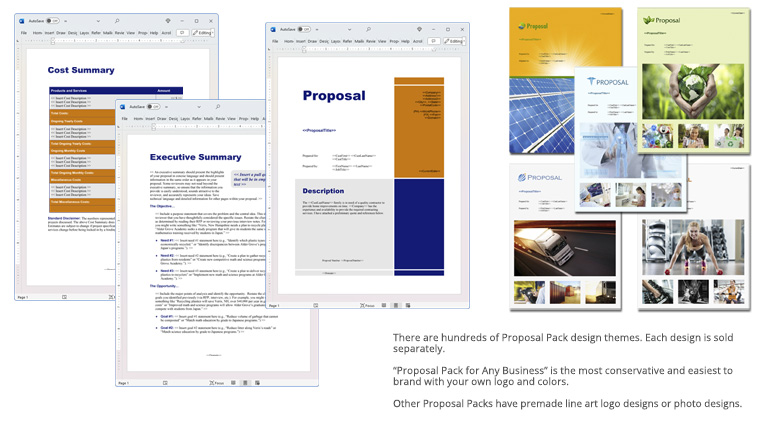

You can create this document using any of the logo-designed Proposal Packs. Pick any Proposal Pack with a logo design theme you like best; they will all work equally well. The Proposal Pack for Any Business is the pack with no extra added logos or colors - designed to be used plain or for you to customize with your logos and graphics.

The Proposal Pack design theme you purchase will determine the visual look of this template. The screenshot above only shows the plain generic design theme. Names and stories in examples are fictional; however, the templates are from real client use cases.

We include a library of chapters to be assembled based on your needs. All proposals are different and have different needs and goals. We designed Proposal Pack so you can customize the documents to suit your needs.

You will best create this document using the Proposal Pack Wizard - Expert Edition software to select this template and build it in the Proposal Pack logo design theme of your choice along with any desired customizations (such as adding additional chapters, removing unneeded chapters, changing the order of chapters, and importing your company logo). This template outlines a proposal for the described situation. Each user is responsible for typing in the actual content of the provided pages with their information to complete the proposal.

You create this template using the Wizard software with an entire Proposal Pack library and software. We include the Expert Edition of the software in the Proposal Kit Professional bundle. Microsoft Word for Windows is required to use the customizing software.

Key Takeaways

- The Merger of Companies Proposal is a selectable proposal template layout.

- You can create unlimited custom variations of this template using a Proposal Pack or the Professional Bundle.

- Using a Proposal Pack or Professional Bundle, you can automate quotes and other financial pages with a line-item database.

- There are no ongoing subscription fees. You get lifetime unlimited use.

- We made Proposal Kit for freelancers, small businesses, and non-profits.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.By Ian Lauder

Published by Proposal Kit, Inc.

Published by Proposal Kit, Inc.

Cart

Cart

Facebook

Facebook YouTube

YouTube X

X Search Site

Search Site