How to write your Authorization to Charge Credit Card

We include this 1 page template with Contractors Contract Pack and the Proposal Kit Professional. You will get more content and software automation for data merging, managing client documents, and creating proposals with line item quoting with a Contract Pack or the Professional.

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES What Our Clients Say

What Our Clients SayWhen I use the Contract Pack, it gives me many options that are professional and work well."

CEO at Dealer Dimensions

1. Get Contractors Contract Pack or the single template that includes this business contract document.

We include this contract in editable Word format that can be customized using your office software.

2. Download and install after ordering.

Once you have ordered and downloaded your template or pack, you will have all the content you need to get started.

3. Customize the contract template with your information.

You can customize the contract document as much as you need. If you get a Contract Pack or Professional Bundle, you can also use the included Wizard software to automate name/address data merging.

Use cases for this template

Sunridge Events secures a venue with a card-not-present deposit

The Challenge

Sunridge Events LLC needed to reserve a venue for Bayview Arts Council on a tight deadline, but the client preferred to use a credit card and could not come in person; the team required a signed authorization with cardholder name, total, and a clear signature box while avoiding email transmission and keeping the paper stored securely.

The Solution

They issued the printed authorization form for a deposit, asked the client to fax it, and added a verification successful waiting step so Accounting could match the cardholder name and billing address to the invoice before charging the customer's card, a control designed to reduce disputes and fraud risk.

The Implementation

Accounting logged receipt, confirmed phone details, checked each field box for accuracy, and filed the physical record in a locked cabinet; Proposal Kit's document assembly produced the event proposal with automated line-item quoting, while its AI Writer generated a payment instructions sheet and an internal handling guideline to support the legal contract.

The Outcome

The payment authorization cleared smoothly, the venue was secured on time, and Sunridge gained the advantage of a strong audit trail with fewer chargebacks while clients appreciated a simple process that protected their data.

North Fork Equipment Rentals protects a high-value skid-steer rental

The Challenge

Trident Builders needed weekend equipment and agreed to a deposit plus incidentals using a printed card authorization, but North Fork had to verify the cardholder, protect card information, and prove permission to charge for certain transactions if damage occurred.

The Solution

They required the completed form with the cardholder's name exactly as on the statement, performed a successful verification, waited for review, and limited retained data to card type and the last four digits after processing the payment on the customer's card.

The Implementation

Counter staff checked ID against the form, noted the job reference, and stored the original document securely; using Proposal Kit, management assembled a rental quote with line-item totals, and the AI Writer produced a risk-mitigation memo, a counter checklist, and clear customer instructions for each box on the form.

The Outcome

The transaction closed without dispute, North Fork reduced fraud exposure and administrative time, and Trident Builders got fast access to equipment with transparent terms.

BlueGrove Analytics locks in a consulting kickoff retainer

The Challenge

Hearthstone Foods selected BlueGrove for a data project, but needed to proceed before procurement finished onboarding, so a mailed card authorization for the retainer was the fastest way to pay while keeping payment information off email.

The Solution

BlueGrove requested the signed form, instituted a verification successful waiting period to match the invoice, cardholder name, and billing address, and outlined that the charge covered a retainer deposit only, not recurring transactions.

The Implementation

Finance assigned a unique file ID, confirmed by phone, processed the card, then redacted the number and stored the record securely; Proposal Kit generated the detailed proposal with line-item quoting, and its AI Writer produced a project kickoff plan, a reconciliation checklist, and a brief policy explaining how staff should handle each form field box.

The Outcome

The retainer posted on schedule, BlueGrove started discovery immediately, and both parties benefited from clear consent, tighter controls, and documented procedures that protect data.

Abstract

This credit card authorization form enables a business (the merchant) to obtain a cardholder's clear consent and permission to charge their credit card for a specified amount. The form is a document designed for card-not-present situations, where the person is not physically present at checkout. It requests credit card information and billing address exactly as they appear on the statement, including card type, number, expiration date, CVV, total amount, and the cardholder's signature and current date. Capturing accurate payment information helps verify identity, reduce chargebacks, and lower fraud risk for certain transactions.

The authorization process is straightforward: the customer prints, completes, signs, and either faxes the form to Accounting or mails it to the listed business address. Email or other digital delivery is not accepted, which can protect sensitive data by limiting online exposure. After receiving the form, employees can verify details and, if needed, contact the cardholder by phone to confirm consent before proceeding. Waiting for verification to be successful helps the merchant comply with internal guidelines and fraud prevention practices.

This process suits deposits, professional services billed in advance, phone orders, or one-off card payment situations where a secure online connection or full e-commerce system is not in place. It can also serve when requesting payment authorization for manual review. For recurring payments or recurring transactions, businesses typically use a separate form that records ongoing consent; this document focuses on a specific transaction amount.

Merchants should store the record securely in a file, keep card information protected, and limit access to authorized employees. Internally, a reference such as a ticket, invoice number, or even a ray ID from related logs can be noted to link the physical form to the transaction data, helping the business respond to inquiries and reduce risk.

Use cases include B2B retainers, event deposits, equipment rentals, and service calls where consumers prefer to pay by card and the merchant needs written permission to charge their credit card. Alternatively, a business can guide customers to an online process when available.

Proposal Kit can help organizations assemble documents like this, generate automated line-item quoting for estimates and invoices, and use its AI Writer to build supporting policies and procedures. Its extensive template library and ease of use make it practical to standardize forms and related business paperwork.

Additional insight for business readers: Paper-based authorization can be built into a simple risk workflow that fits card-not-present operations. Add a verification successful waiting step before processing, so staff can confirm the cardholder's name, address, and total against the invoice. Make each field box on the form clear and legible, especially the cardholder's name and signature, to validate consent to use a credit card.

When a deposit is required for an event, rental, or service call, this form documents permission to charge the customer's card for the stated amount. The advantage for the merchant is a stronger audit trail to respond to inquiries and reduce disputes. Once received, keep the file stored securely, restrict access to a small group, and record who handled it and when. After processing, consider redacting full card information in your retained record while retaining essentials such as card type, last four digits, and authorization date.

Proposal Kit can help you standardize this workflow by assembling the authorization form alongside related materials, quotes with automated line-item totals, instructions for customers on how to complete each box, and internal guidelines for handling sensitive data. Its AI Writer can generate supporting documents like intake checklists and payment policy drafts, while the extensive template library and ease of use help teams roll out consistent, professional paperwork across departments.

Consider adding governance and reconciliation steps around this form to strengthen controls. Define who within the business can accept and process a payment authorization, and require a brief verification and a successful waiting period before charging the customer's card. During that window, Accounting can match the cardholder name, billing address, and Total Amount to the invoice and job record, then document the check as verification successful.

Use a clear box for each field so handwriting is legible, and state whether the payment is a deposit, milestone, or final balance. This clarity helps customers who prefer to use a credit card understand exactly what they will pay and when.

For operations, assign a unique internal reference to every form so employees can trace the transaction from requesting to settlement. Note the person who approved the proceeding and any phone confirmations. Retain only important credit card information in the file, keep the paper stored securely, and record access. After processing, mask sensitive card information in your retained record to protect data and reduce exposure risk.

The advantage to the merchant is cleaner audit trails and fewer disputes, especially for certain transactions like rentals, event holds, or service dispatches. If your business later adopts online card payment methods, keep this form as a fallback for exceptions or offline situations that still require payment authorization tied to a specific transaction.

Proposal Kit can package this form with related documents, quotes with automated line-item totals that align to the Total Amount, intake checklists, and handling guidelines drafted with its AI Writer. Its template library and document assembly workflows help teams standardize language, instructions for each box on the page, and consistent policy language across departments.

How do you write a Authorization to Charge Credit Card document? - The Narrative

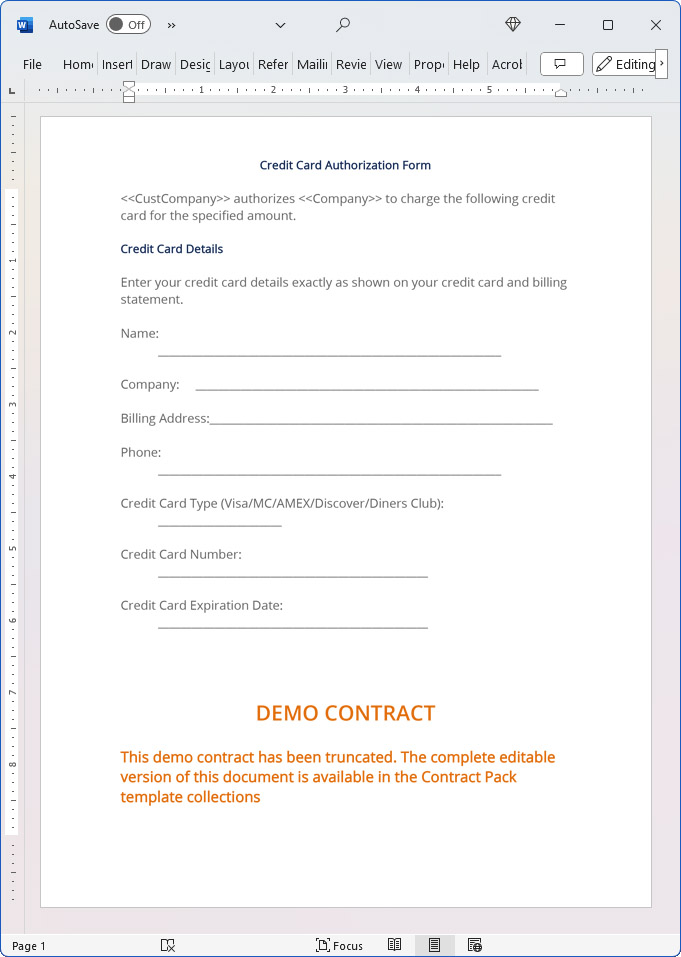

Credit Card Authorization Form

Company Name authorizes Company Name to charge the following credit card for the specified amount.

Credit Card Details

Enter your credit card details exactly as shown on your credit card and billing statement.

Billing Address:

Credit Card Type (Visa/MC/AMEX/Discover/Diners Club):

Credit Card Number:

Credit Card Expiration Date:

Credit Card CVV2 Security Code: (printed on front or back of card).

Total Amount:

Authorization Signature:

Current Date: Current Date

Fax / Mailing Instructions

Print and Fax this form to:

Company Name Attention: Accounting Dept - Fax Fax Number.

Or print and mail this form to:

Company Name

City, State Postal Code

Important: Email, Adobe PDF, Email Faxes or other Electronic delivery of this form will NOT be accepted.

20% Off Discount

![]() Add To Cart This Word Template Only

Add To Cart This Word Template Only

Add To Cart Contractors Contract Pack

Add To Cart Contractors Contract Pack

Add To Cart Proposal Kit Professional Bundle

Add To Cart Proposal Kit Professional Bundle

4.7 stars, based on 849 reviews

4.7 stars, based on 849 reviewsRelated Documents

How to Build a Legal Contract with Proposal Kit

This video illustrates how to create a legal contract using the Proposal Pack Wizard software. It also shows how to create a proposal with an invoice and contract at the same time.

Frequently Asked Questions

How do I customize this contract to fit my business needs?

Customizing this contract involves editing the document to include your business details, terms, and conditions. The templates are designed to be flexible, allowing you to insert your company's name, address, and other relevant information. You can modify clauses to reflect your unique business practices and legal requirements.

Is this contract compliant with laws and regulations?

The legal contract templates are written by legal professionals and designed to comply with current laws and regulations at the time of their writing. However, laws can vary by jurisdiction and change over time, so it's recommended to have your contract reviewed by a local attorney to ensure it meets all legal requirements specific to your region and industry. Templates are licensed as self-help information and not as legal advice.

Can I use the same contract for different clients or projects?

You can use the same contract for different clients or projects. The templates are versatile and easily adapted for various scenarios. You will need to update specific details such as client names, project descriptions, and any unique terms for each new agreement to ensure that each contract accurately reflects the particulars of the individual client or project.

What should I do if I encounter a clause or term I don't understand?

If you encounter a clause or term in the contract that you need help understanding, you can refer to guidance notes explaining each section's purpose and use. For more complex or unclear terms, it's advisable to consult with a legal professional who can explain the clause and help you determine if any modifications are necessary to suit your specific needs.

How do I ensure that the contract is legally binding and enforceable?

To ensure that the contract is legally binding and enforceable, follow these steps:

- Complete all relevant sections: Make sure all blanks are filled in with accurate information.

- Include all necessary terms and conditions: Ensure that all essential elements, such as payment terms, deliverables, timelines, and responsibilities, are clearly defined.

- Signatures: Both parties must sign the contract, and it is often recommended that the contract be witnessed or notarized, depending on the legal requirements in your jurisdiction.

- Consult a legal professional: Before finalizing the contract, have it reviewed by an attorney to ensure it complies with applicable laws and protects your interests.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.By Ian Lauder

Published by Proposal Kit, Inc.

Published by Proposal Kit, Inc.Disclaimers

Proposal Kit, Inc. makes no warranty and accepts no responsibility for the suitability of any materials to the licensee's business. Proposal Kit, Inc. assumes no responsibility or liability for errors or inaccuracies. Licensee accepts all responsibility for the results obtained. The information included is not legal advice. Names in use cases have been fictionalized. Your use of the contract template and any purchased packages constitutes acceptance and understanding of these disclaimers and terms and conditions.

Cart

Cart

Get 20% off ordering today:

Get 20% off ordering today:

Facebook

Facebook YouTube

YouTube Bluesky

Bluesky Search Site

Search Site