How to write your Asset Destruction Loss Worksheet

We include this 1 page template with IT/Software/Hardware Contract Pack and the Proposal Kit Professional. You will get more content and software automation for data merging, managing client documents, and creating proposals with line item quoting with a Contract Pack or the Professional.

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES What Our Clients Say

What Our Clients SayYour contract templates are the very best that I have found!"

1. Get IT/Software/Hardware Contract Pack or the single template that includes this business contract document.

We include this contract in editable Word format that can be customized using your office software.

2. Download and install after ordering.

Once you have ordered and downloaded your template or pack, you will have all the content you need to get started.

3. Customize the contract template with your information.

You can customize the contract document as much as you need. If you get a Contract Pack or Professional Bundle, you can also use the included Wizard software to automate name/address data merging.

Use cases for this template

BlueHarbor Rentals Survives a Water Damage Hit

The Challenge

When a burst pipe flooded two units at BlueHarbor Rentals LLC, Property Manager Maria Chen faced the disposition of appliances and a depreciating HVAC unit owned for five years, needed to tie losses to rental income on Schedule E, account for insurance cash, scrap sales price, and expenses, and be aware that rules for a main home are excluded and do not qualify, all while keeping financial statements accurate for multiple entities.

The Solution

Maria used the Business Asset Casualty/Loss Worksheet to capture each individual asset, the date of loss, cost, reason, and totals, then paired it with a depreciation worksheet to figure accumulated depreciation, calculate adjusted basis, and recognize any gain or loss; she posted the following journal entry to remove cost and accumulated depreciation, allocate cash receipts and scrap proceeds, and update the account balances and report package.

The Implementation

She recorded the transaction details, documented ownership and location, set an estimated salvage price and later updated it with the receipt, and scheduled review so the sale of scrap reflected the actual date sold; Proposal Kit was used only to create supporting documents-an incident report, a replacement-cost estimate using automated line-item quoting, and an AI Writer narrative for a management report-assembled with its template library.

The Outcome

BlueHarbor closed the period on time, recognized results correctly, kept other assets unaffected, and delivered a clean audit trail that linked the worksheet, journal entry, and supporting schedules, making the point that disciplined asset disposal improves income reporting and speeds lender and insurer reviews when more help from advisors is needed.

IronPeak Manufacturing Rebounds After a Shop Fire

The Challenge

A fire damaged machinery and a parts vehicle at IronPeak Manufacturing, and CFO DeShawn Price had to manage the disposal of business property across two plants, separate land values excluded from depreciation, document each disposition, and calculate whether the sale of recoverable components produced a gain or loss, all within the monthly close schedule.

The Solution

The team logged every asset on the worksheet with costs, reasons, and totals, attached a depreciation schedule to show accumulated depreciation and service life, set the date sold and sales price for scrapped items, and prepared the journal entry that cleared the assets from the fixed-asset account and recorded cash proceeds and expenses while keeping financial statements consistent across entities.

The Implementation

DeShawn allocated proceeds by portion to the affected items, captured vendor quotes and adjuster statements, then used the Proposal Kit only for auxiliary documents: a board briefing paper drafted with the AI Writer, a capital replacement plan with line-item quoting to price new equipment, and a program of standardized reports assembled from templates to guide procurement.

The Outcome

IronPeak recognized appropriate results on each transaction, controlled ownership records, and accelerated approvals for replacements, with clearer budgeting signals and a documented trail that let auditors trace every figure from receipt to journal entry without surprises.

TerraNova Logistics Streamlines Fleet Disposal After a Collision

The Challenge

Fleet Manager Lila Gomez at TerraNova Logistics needed to dispose of a totaled vehicle after a highway collision, record towing and repair expenses, estimate a salvage price, and ensure the gain or loss and income effects were reported correctly while keeping the rest of the fleet's service schedules and other assets intact.

The Solution

She completed the worksheet for the vehicle with the date of loss, cost, and reason, attached the depreciation worksheet to calculate adjusted basis, entered the actual sales price when the unit was sold for parts, and posted the following journal entry to recognize the disposition and update accounts and financial statements.

The Implementation

To support the contract, TerraNova used Proposal Kit only for extra documents: an AI Writer incident narrative for executives, a safety program update, and a replacement-vehicle proposal with automated line-item quoting to compare price options, all assembled from templates that matched the accounting schedule and close timeline.

The Outcome

The company recognized results promptly, improved awareness of fleet risks, and produced a concise report package that satisfied internal reviewers and insurers, making it easier to calculate impacts, allocate costs, and move quickly from loss to replacement without disrupting operations.

Abstract

This Business Asset Casualty/Loss Worksheet helps organizations document the disposition of business property when an unexpected event damages or destroys an individual asset. It gathers the essentials: asset description, date of loss, cost, reason, and totals for report support. With these baseline facts, finance teams can calculate write-offs and prepare the following journal entry that removes the depreciating asset from the account records and updates financial statements.

In practice, you will pair this worksheet with a depreciation worksheet or schedule that shows accumulated depreciation for the asset while it was in service. That lets you figure the adjusted basis and determine whether you recognize a gain or loss on disposal. If there is a sale or insurance proceeds, record the sales price or cash receipt and compare it to the basis to calculate any gain.

If proceeds exceed basis, you may see a full gain; if not, a loss. If no documentation is available, note an estimated amount and explain the assumption. Be aware that land is excluded from depreciation, so allocate any property price between land and improvements before computing results.

Typical use cases include machinery damaged by a flood, a vehicle totaled in a collision, or other assets like computers stolen from a workplace. For rental property owners, the worksheet supports Schedule E reporting by connecting rental income and expenses to asset disposal records for appliances, roofing, or HVAC units owned for five years or more. Business entities of all sizes can attach this record to a program output from their accounting system to support the journal entry and any external report requests.

This worksheet also supports broader asset management. It documents ownership history, the service life used for depreciation, and the reason for loss or sale. Include the date sold and sales price if the event is a sale rather than a casualty.

For insurance or reimbursements, collect receipts or claim statements to show the portion recovered. The resulting file helps stakeholders evaluate the transaction and confirm that other assets are not affected.

The Proposal Kit can streamline the preparation of this worksheet and related documents. Use its document assembly, automated line-item quoting, AI Writer for supporting narratives, and extensive template library to build consistent packages with ease of use across teams and projects.

Beyond recording losses, this worksheet strengthens internal controls and audit readiness. It standardizes how teams document asset disposition, link each account to supporting evidence, and reconcile the adjusted basis to the fixed-asset subledger. When proceeds or insurance cash arrive, finance can allocate amounts across multiple items and calculate the recognized gain or loss, then post the following journal entry and update the report package. For consolidated entities, a consistent program of documentation helps compare income and expenses across divisions and figure trends in asset disposal.

Consider this example: a rental property suffers a pipe break that ruins appliances and a depreciating HVAC unit. The worksheet captures the costs, accumulated depreciation, and any sales price from scrapping parts, plus the receipt from the insurer. The records flow into the Schedule E workpapers to align rental income with the disposition of those assets.

By contrast, assets tied to a main home may not qualify for the same treatment; the point is to be aware that business property and personal-use property follow different rules. If a vehicle is sold after a casualty or machinery is sold for parts, note the date sold, price, and portion recovered so you can calculate results with more help from your advisors.

The Proposal Kit can streamline assembling these packages. Use its document assembly to produce consistent files, automated line-item quoting for cost breakdowns, the AI Writer to write supporting narratives, and its extensive template library to build clear, reusable schedules with ease of use for non-accountants and controllers alike.

Expand your use of the worksheet by linking it to your monthly close. Capture the incident within the correct time period so the loss hits the right report cycle. Reconcile each individual asset to the fixed-asset subledger, then post entries that remove cost and accumulated depreciation and record any proceeds.

Tie the results to your financial statements package with a clear audit trail. If you maintain both book and tax records, flag any differences so your team can align income reporting and future depreciation schedules without surprises.

Consider component assets and partial disposals. When you replace a roof, a production line motor, or a vehicle transmission, record the disposition of the retired component, not just the whole unit. Allocate cash proceeds, scrap value, and expenses across affected items so you can measure the true gain or loss per transaction. These details feed capital planning: track the frequency and price of disposals to improve budgets, set replacement cycles, and negotiate better warranties for machinery and other assets.

Stronger documentation speeds insurance and lender reviews. Keep photos, serial numbers, incident summaries, vendor quotes, and adjuster statements with the worksheet. Use consistent naming, asset tags, and location codes to match records to the account balance.

Apply materiality thresholds so teams focus effort where it matters, while still retaining evidence for smaller events. For nonprofits or multi-entity groups, a uniform approach improves comparisons and supports centralized oversight.

Proposal Kit helps teams package this information quickly. Build standardized worksheets, incident reports, and roll-forward schedules with document assembly. Use automated line-item quoting to estimate replacement costs and show the portion of expenses to be capitalized versus expensed.

The AI Writer can write concise management narratives that explain the event, the allocation method, and the impact on income. Its template library promotes consistency across entities and periods, improving ease of use and review.

How do you write a Asset Destruction Loss Worksheet document? - The Narrative

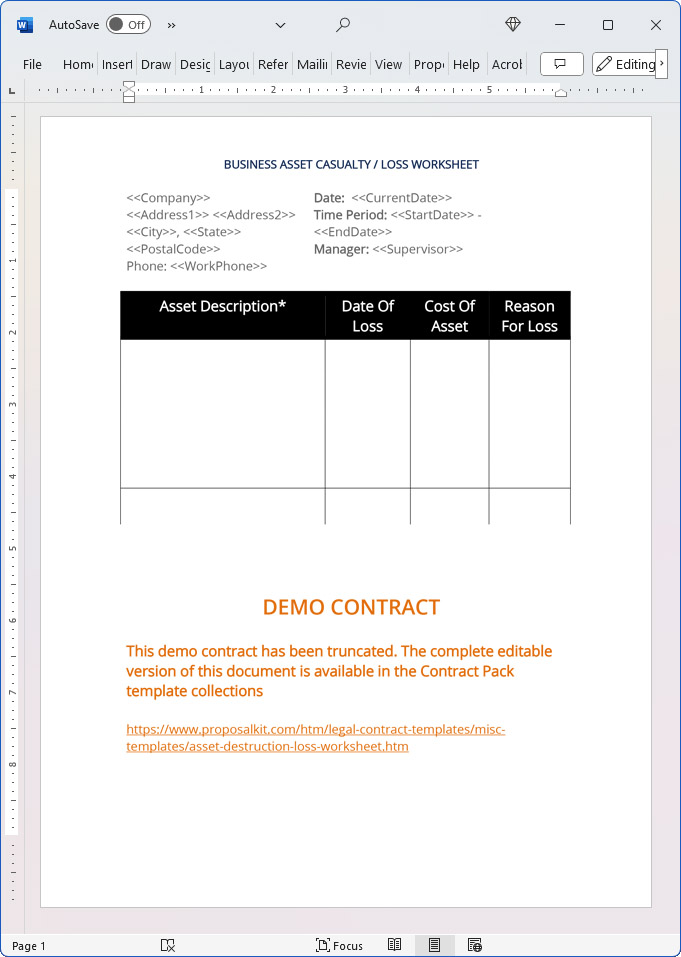

BUSINESS ASSET CASUALTY / LOSS WORKSHEET.

Company Name

Address Address

City, State Postal Code

Phone: Phone Number DATE: Current Date. Time Period: Start Date - End Date.

Manager: Supervisor

ASSET DESCRIPTION DATE of LOSS COST of ASSET REASON for LOSS TOTAL.

20% Off Discount

![]() Add To Cart This Word Template Only

Add To Cart This Word Template Only

Add To Cart IT/Software/Hardware Contract Pack

Add To Cart IT/Software/Hardware Contract Pack

Add To Cart Proposal Kit Professional Bundle

Add To Cart Proposal Kit Professional Bundle

4.7 stars, based on 849 reviews

4.7 stars, based on 849 reviewsHow to Build a Legal Contract with Proposal Kit

This video illustrates how to create a legal contract using the Proposal Pack Wizard software. It also shows how to create a proposal with an invoice and contract at the same time.

Frequently Asked Questions

How do I customize this contract to fit my business needs?

Customizing this contract involves editing the document to include your business details, terms, and conditions. The templates are designed to be flexible, allowing you to insert your company's name, address, and other relevant information. You can modify clauses to reflect your unique business practices and legal requirements.

Is this contract compliant with laws and regulations?

The legal contract templates are written by legal professionals and designed to comply with current laws and regulations at the time of their writing. However, laws can vary by jurisdiction and change over time, so it's recommended to have your contract reviewed by a local attorney to ensure it meets all legal requirements specific to your region and industry. Templates are licensed as self-help information and not as legal advice.

Can I use the same contract for different clients or projects?

You can use the same contract for different clients or projects. The templates are versatile and easily adapted for various scenarios. You will need to update specific details such as client names, project descriptions, and any unique terms for each new agreement to ensure that each contract accurately reflects the particulars of the individual client or project.

What should I do if I encounter a clause or term I don't understand?

If you encounter a clause or term in the contract that you need help understanding, you can refer to guidance notes explaining each section's purpose and use. For more complex or unclear terms, it's advisable to consult with a legal professional who can explain the clause and help you determine if any modifications are necessary to suit your specific needs.

How do I ensure that the contract is legally binding and enforceable?

To ensure that the contract is legally binding and enforceable, follow these steps:

- Complete all relevant sections: Make sure all blanks are filled in with accurate information.

- Include all necessary terms and conditions: Ensure that all essential elements, such as payment terms, deliverables, timelines, and responsibilities, are clearly defined.

- Signatures: Both parties must sign the contract, and it is often recommended that the contract be witnessed or notarized, depending on the legal requirements in your jurisdiction.

- Consult a legal professional: Before finalizing the contract, have it reviewed by an attorney to ensure it complies with applicable laws and protects your interests.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.By Ian Lauder

Published by Proposal Kit, Inc.

Published by Proposal Kit, Inc.Disclaimers

Proposal Kit, Inc. makes no warranty and accepts no responsibility for the suitability of any materials to the licensee's business. Proposal Kit, Inc. assumes no responsibility or liability for errors or inaccuracies. Licensee accepts all responsibility for the results obtained. The information included is not legal advice. Names in use cases have been fictionalized. Your use of the contract template and any purchased packages constitutes acceptance and understanding of these disclaimers and terms and conditions.

Cart

Cart

Get 20% off ordering today:

Get 20% off ordering today:

Facebook

Facebook YouTube

YouTube Bluesky

Bluesky Search Site

Search Site