How to write your Chargeback Reversal Agreement (Standard)

We include this 1 page template with IT/Software/Hardware Contract Pack and the Proposal Kit Professional. You will get more content and software automation for data merging, managing client documents, and creating proposals with line item quoting with a Contract Pack or the Professional.

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES What Our Clients Say

What Our Clients SayI actually purchased the Proposal Kit, HR Contract Pack, and Proposal Wizard yesterday and have created what I believe is an AWESOME proposal! We’ll see if I land the consultancy! I’ll keep ya posted!"

1. Get IT/Software/Hardware Contract Pack or the single template that includes this business contract document.

We include this contract in editable Word format that can be customized using your office software.

2. Download and install after ordering.

Once you have ordered and downloaded your template or pack, you will have all the content you need to get started.

3. Customize the contract template with your information.

You can customize the contract document as much as you need. If you get a Contract Pack or Professional Bundle, you can also use the included Wizard software to automate name/address data merging.

Use cases for this template

Mia at Harbor Thread Co. untangles statement confusion that triggered friendly fraud

The Challenge

When several consumers saw "HTC Processing" on their credit card statements and disputed a charge, the cardholder's issuing bank initiated chargeback claims that pulled funds from the merchant account mid-clearing process, creating costly risk and customer complaints despite authorized online transactions and clean transaction records.

The Solution

Mia used the chargeback reversal authorization to let customers consent to undo error-driven claims and prevent payment reversals, paired with clear messaging about the chargeback process, what typically occurs, and how the acquiring bank and payment processors handle the disputed amount, so customers knew what to expect.

The Implementation

With Proposal Kit, her team created supporting documents: a plain-language article explaining steps involved, a printable "recognize our business name" guide for the customer's account, and an FAQ; the AI Writer produced a short report for stakeholders outlining strategies to mitigate friendly fraud and a communication plan, while line-item quoting generated replacement-order quotes when a different payment method or size exchange was needed.

The Outcome

Timely contact and documentation helped customers initiate reversal requests quickly, minimize escalation, and restore revenue with minimal impact; ratios improved, penalties were avoided, and the operation gained protection without over-refunding or simply accepting every claim.

Raj at BlueLedger Analytics resolves duplicate billing confusion for B2B subscriptions

The Challenge

A billing sync error led to the same transaction appearing twice with an incorrect amount on a client's account statement, and finance teams at clients filed chargeback claims that threatened to escalate, putting BlueLedger's reputation and cash flow at high risk across different types of debit and credit transactions.

The Solution

Raj paired the reversal authorization with a root-cause narrative so cardholders could accept the correction, while his staff verified the cardholder's identity, confirmed the original credit transaction was authorized, and explained the exact process with realistic expectations about timing and approval by the acquiring bank.

The Implementation

Using Proposal Kit, they assembled a corrective billing packet: a reconciliation memo, delivery and usage evidence, and a manager-signed letter outlining the course of action; the AI Writer generated a post-incident study, a policy update, and a training script, and line-item quoting produced service-credit and upgrade offers to keep a positive customer experience.

The Outcome

Most clients approved reversals within days, funds settled back after review, and BlueLedger did not lose revenue or become liable for additional fees; clearer materials reduced inquiries by phone and email, and stakeholders gained knowledge to manage future scenarios smoothly.

Lena at Urban Cartwheel curbs chargebacks in a card-not-present delivery marketplace

The Challenge

A spike in customer disputes tied to delivery timing and address errors created confusion between fraudulent charges and misunderstandings, and what typically occurs in such a scenario, rapid bank holds and notifications put the business responsible for the disputed amount until the networks decide.

The Solution

Lena implemented the reversal authorization for cases where consumers recognized the order after a notification and consented to reverse the claim, while adding additional layers of documentation to protect against truly fraudulent activity and to prevent payment reversals from becoming a costly pattern.

The Implementation

Proposal Kit produced a store-ready documentation kit: courier handoff receipts, order recognition checklists, and a customer-facing explainer on the steps involved and who to contact; the AI Writer prepared a risk brief and a mitigation plan for leadership, and line-item quoting created standardized re-delivery and restocking quotes when customers chose to cancel and re-order.

The Outcome

By communicating early, verifying identities, and delivering evidence fast, Urban Cartwheel reduced the likelihood of escalation, restored funds more often, and improved satisfaction scores; the combined toolkit proved a game changer in navigating rules while maintaining protection for both parties.

Abstract

This credit card chargeback reversal authorization is a simple mechanism to correct payment disputes that were filed in error. It identifies the parties involved-the cardholder and the merchant-and the payment method used (Visa, Mastercard, Discover, American Express, or other). When a customer initiates a dispute and the cardholder's issuing bank or the bank initiates a payment reversal, this form lets the customer agree to undo that action and restore the original transaction. It supports dispute resolution while protecting the merchant account and the business's reputation.

The form requires the customer to print, sign, and fax or mail it to the business name and address; electronic delivery is not accepted. That clear understanding of the exact process helps minimise confusion, timing issues, and compliance concerns under card network rules. The document also notes that with sufficient tracking and transaction data, the merchant can submit a rebuttal to the issuer without a customer signature and request further investigation, useful in friendly fraud chargebacks and other unwarranted chargebacks.

Using this reversal request can significantly reduce the cost and risk of payment disputes. It can help avoid chargebacks and associated fees, including a chargeback fee and additional fees that may follow, as well as the indirect impact on interchange fees and acquirers' risk ratings. Strong documentation, including receipts, delivery proof, transaction records, and evidence of the original transaction amount, helps verify the customer's payment card activity and protect both parties' funds. Timely communication and the ability to respond quickly often prevent chargebacks from escalating and keep customer satisfaction high.

Common situations include customer confusion about the business name on a credit card statement, a wrong amount showing on the account statement, duplicate billing for the same transaction, or online transactions that the consumer recognizes only after a bank notification. In such cases, once the customer agrees that the claim was incorrect, they can file and submit this form so processors can resolve the claim and restore money to the merchant's bank account after settlement. Implementing fraud prevention tools, such as biometric authentication and address verification, also helps prevent fraudulent transactions and friendly fraud, keeping dollars and revenue flow with minimal impact.

Proposal Kit can streamline creating forms like this alongside refund policies and communications. Its document assembly, automated line-item quoting, AI Writer, and extensive template library help businesses produce consistent paperwork and supporting documents quickly, improving accuracy and ease of use across different situations.

Beyond the basics, it helps to map the chargeback process so teams know the steps involved and can respond with realistic expectations. A customer typically disputes a charge with the cardholder's issuing bank, which initiates a claim that flows through the card network to the acquiring bank and payment processors. Funds from the original credit transaction or debit pull may be moved out of the merchant account during the clearing process while the disputed amount is reviewed.

When a customer makes an error-driven claim, such as an incorrect amount, a different payment method showing on the customer's account, or a business name they do not recognize, this reversal authorization lets the cardholder consent to undo the action. Used correctly, it can mitigate harm, prevent payment reversals from escalating, and support a positive customer experience.

Operationally, train staff to verify the cardholder's identity, communicate by phone when needed, and document every inquiry and customer complaint without assuming fraudulent charges. High-risk categories may need additional layers of proof. There are different types of situations that lead to chargeback claims; three types you'll see often include misunderstandings, delivery timing, and duplicate billing.

Do not simply accept every claim or cancel an approved order without review; decide based on evidence and determine whether the transaction was authorized. If not managed, penalties and ratios can become costly, and you may lose revenue or be liable for more fees. Notify customers about policies, pay close attention to timing, and contact processors early to navigate options. While no process can guarantee outcomes, clear strategies, fast communication, and accurate documentation significantly reduce the likelihood that a dispute will escalate.

For many teams, having ready-to-use paperwork is a game-changer. Proposal Kit helps businesses assemble this form, related refund language, and response letters quickly. Its document assembly, automated line-item quoting, AI Writer for supporting documents, and extensive template library help you manage consistent policies, deliver clear instructions, and streamline communications across your store and service lines.

A practical way to frame this topic is to map what typically occurs when customer disputes arise. Consumers often notice an unfamiliar line item and initiate a claim; the merchant should acknowledge it fast, verify the cardholder, and provide receipts and tracking while offering the reversal authorization as a clean path to resolution. Set what customers can expect in clear messages: outline timelines, what documentation is needed, and how funds flow if the chargeback is reversed. Assign a responsible internal owner for each phase so no step is missed during review and communication.

Build a knowledge playbook that includes scripts, checklists, and a decision tree for each scenario, from simple recognition issues to shipment questions. Define the course of action for collecting evidence and confirming consent, and keep a log of outcomes to improve response times. Maintain protection by following data handling standards and limiting sensitive details to what is necessary to validate the claim. This article's approach helps teams coordinate faster, reduce confusion, and close more cases efficiently while preserving customer trust and revenue.

How to write my Chargeback Reversal Agreement (Standard) document - The Narrative

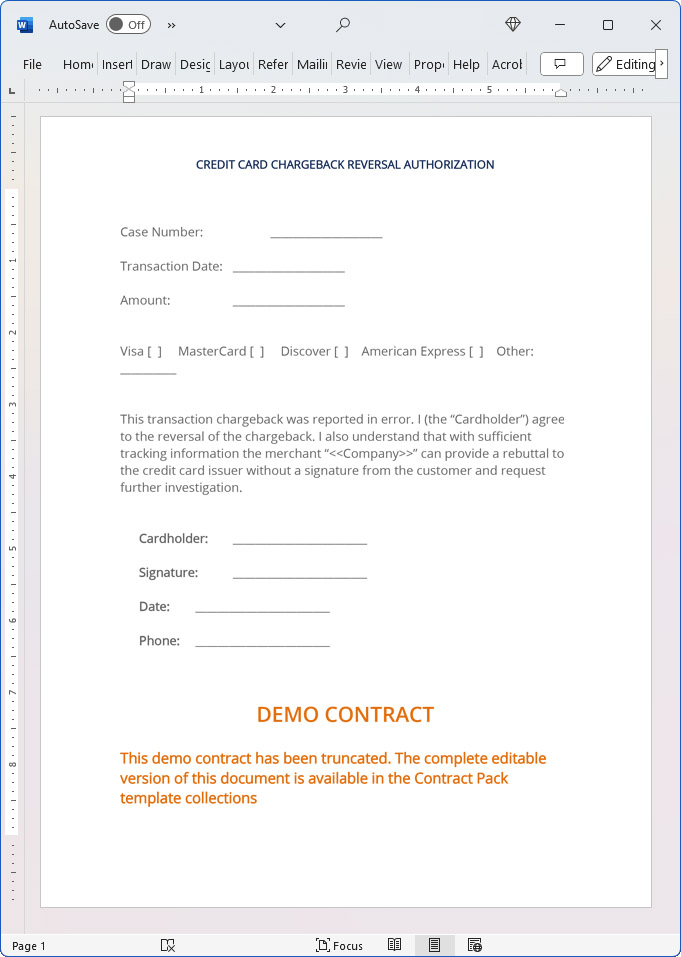

CREDIT CARD CHARGEBACK REVERSAL AUTHORIZATION.

Case Number:

Transaction Date:

Visa [ ] MasterCard [ ] Discover [ ] American Express [ ] Other:

This transaction chargeback was reported in error. I (the "Cardholder") agree to the reversal of the chargeback. I also understand that with sufficient tracking information the merchant "Company Name" can provide a rebuttal to the credit card issuer without a signature from the customer and request further investigation.

Print and Fax this form to:

Company Name Attention: Sales Dept - Fax Fax Number.

Print and mail this form to:

Company Name

City, State Postal Code

Important: Email, Adobe PDF, Email Faxes or other Electronic delivery of this form will NOT be accepted.

20% Off Discount

![]() Add To Cart This Word Template Only

Add To Cart This Word Template Only

Add To Cart IT/Software/Hardware Contract Pack

Add To Cart IT/Software/Hardware Contract Pack

Add To Cart Proposal Kit Professional Bundle

Add To Cart Proposal Kit Professional Bundle

4.7 stars, based on 849 reviews

4.7 stars, based on 849 reviewsAlternate Documents

How to Build a Legal Contract with Proposal Kit

This video illustrates how to create a legal contract using the Proposal Pack Wizard software. It also shows how to create a proposal with an invoice and contract at the same time.

Frequently Asked Questions

How do I customize this contract to fit my business needs?

Customizing this contract involves editing the document to include your business details, terms, and conditions. The templates are designed to be flexible, allowing you to insert your company's name, address, and other relevant information. You can modify clauses to reflect your unique business practices and legal requirements.

Is this contract compliant with laws and regulations?

The legal contract templates are written by legal professionals and designed to comply with current laws and regulations at the time of their writing. However, laws can vary by jurisdiction and change over time, so it's recommended to have your contract reviewed by a local attorney to ensure it meets all legal requirements specific to your region and industry. Templates are licensed as self-help information and not as legal advice.

Can I use the same contract for different clients or projects?

You can use the same contract for different clients or projects. The templates are versatile and easily adapted for various scenarios. You will need to update specific details such as client names, project descriptions, and any unique terms for each new agreement to ensure that each contract accurately reflects the particulars of the individual client or project.

What should I do if I encounter a clause or term I don't understand?

If you encounter a clause or term in the contract that you need help understanding, you can refer to guidance notes explaining each section's purpose and use. For more complex or unclear terms, it's advisable to consult with a legal professional who can explain the clause and help you determine if any modifications are necessary to suit your specific needs.

How do I ensure that the contract is legally binding and enforceable?

To ensure that the contract is legally binding and enforceable, follow these steps:

- Complete all relevant sections: Make sure all blanks are filled in with accurate information.

- Include all necessary terms and conditions: Ensure that all essential elements, such as payment terms, deliverables, timelines, and responsibilities, are clearly defined.

- Signatures: Both parties must sign the contract, and it is often recommended that the contract be witnessed or notarized, depending on the legal requirements in your jurisdiction.

- Consult a legal professional: Before finalizing the contract, have it reviewed by an attorney to ensure it complies with applicable laws and protects your interests.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.By Ian Lauder

Published by Proposal Kit, Inc.

Published by Proposal Kit, Inc.Disclaimers

Proposal Kit, Inc. makes no warranty and accepts no responsibility for the suitability of any materials to the licensee's business. Proposal Kit, Inc. assumes no responsibility or liability for errors or inaccuracies. Licensee accepts all responsibility for the results obtained. The information included is not legal advice. Names in use cases have been fictionalized. Your use of the contract template and any purchased packages constitutes acceptance and understanding of these disclaimers and terms and conditions.

Cart

Cart

Get 20% off ordering today:

Get 20% off ordering today:

Facebook

Facebook YouTube

YouTube Bluesky

Bluesky Search Site

Search Site