How to write your Chargeback Reversal Agreement (Stronger)

We include this 1 page template with IT/Software/Hardware Contract Pack and the Proposal Kit Professional. You will get more content and software automation for data merging, managing client documents, and creating proposals with line item quoting with a Contract Pack or the Professional.

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEESThis version is worded a bit stronger for cases where the customer violated your return policy and did a chargeback without working with you, etc. The intent is to get their statement in writing to take back to the credit card processor in case the customer is not being cooperative. It is always best to have written authorization up front on charges to avoid having to go back to the customer if problems occur as the credit card companies almost always side with the card holder, even if it is a fraudulent chargeback.

What Our Clients Say

What Our Clients SayExcellent contract templates. Using them since 2008!"

Chief Information Officer at Webnauts Net & SEO Workers

1. Get IT/Software/Hardware Contract Pack or the single template that includes this business contract document.

We include this contract in editable Word format that can be customized using your office software.

2. Download and install after ordering.

Once you have ordered and downloaded your template or pack, you will have all the content you need to get started.

3. Customize the contract template with your information.

You can customize the contract document as much as you need. If you get a Contract Pack or Professional Bundle, you can also use the included Wizard software to automate name/address data merging.

Use cases for this template

HarborLine Outdoors turns a "goods not received" claim into a fast reversal

The Challenge

When a large tent order triggered a payment dispute, HarborLine Outdoors' owner Mia Chen received notification with a short timeline and a reason code claiming non-delivery, even though carrier scans showed the package delivered and the buyer had access to tracking in prior customer communications; with limited resources and a fear of ratio impacts, she needed to verify validity, challenge the claim, and avoid penalties and higher fees.

The Solution

Mia called the buyer to clarify the mix-up, then presented the paper-based Chargeback Reversal Authorization, which the authorized cardholder agreed to sign and fax back as required; she prepared to provide compelling evidence if needed, including delivery confirmation, AVS/billing match, IP logs, device fingerprinting, order confirmation, and transaction details to demonstrate a legitimate transaction and create reasonable doubt.

The Implementation

Using Proposal Kit, Mia produced supporting documents around the contract: an internal Dispute Process Playbook, a Customer Communication Script for future disputes, and a Post-Dispute Insights Report generated with the AI Writer; she also used line-item quoting to outline operational costs per case so finance could see the total costs of fighting chargebacks and investing in fraud prevention practices.

The Outcome

The customer faxed the signed form, funds were returned, the acquiring bank closed the case without escalation, and HarborLine used the documentation to standardize its first-line response, reduce delays, and improve success on future disputes while protecting profits and customer experience.

Nimbus Ledger SaaS reins in recurring billing confusion with organized evidence

The Challenge

Nimbus Ledger, led by CFO Aaron Patel, faced a spike in customer disputes on renewals-some initiated after service was delivered-putting them at risk of enforcement audits and termination if the chargeback rate climbed; they needed to answer complaints quickly, verify each claim, and avoid an invalid filing or a forced reversal that could cost them money.

The Solution

They implemented chargeback alerts to stay current on deadlines and used the Chargeback Reversal Authorization when a buyer acknowledged an error but had already filed; for tougher cases, they prepared to submit additional evidence, such as signed receipts where applicable, chat logs, login/access records, confirmation emails, and transaction receipts-to provide evidence aligned to the reason code and defend the account.

The Implementation

With Proposal Kit, the team created supporting materials: a Recurring Billing Transparency Plan and Refund Policy brief, a Subscriber Outreach Guide written with the AI Writer, and a Monthly Chargeback Insights Report benchmarking industry data; line-item quoting documented allocation of dispute work across support and finance so leadership could manage resources and decide when to appeal or refund directly.

The Outcome

Win rate improved, unnecessary escalations dropped, customers who truly canceled were handled promptly, and the company met each deadline, avoided costly penalties, and kept ratio impacts under control while preserving a positive customer experience.

VectorSynch Supply resolves a high-value B2B dispute before arbitration

The Challenge

After shipping 50 rugged tablets to Kestrel Energy, VectorSynch received a chargeback claim from the buyer's financial institution due to an internal A/P mistake, putting a significant invoice at risk and threatening to escalate to pre-arb; with high-risk transactions and tight timelines, they needed to demonstrate the truth fast or risk losing funds.

The Solution

Sales and ops coordinated a collaboration workflow to gather relevant proof-packing slips, signed delivery, invoices, shipping/billing address match, order confirmations, and communication history, and requested the authorized A/P manager sign and mail the Chargeback Reversal Authorization while preparing a representment package in case the bank required evidence provided for final resolution.

The Implementation

Proposal Kit supported the effort with a Chargeback Readiness Brief and an Audit Checklist written using the AI Writer, plus a Cost-of-Disputes Analysis using line-item quoting to quantify the impact on operations; they also produced an Executive Timeline one-pager to keep multiple parties aligned on each deadline and to explain consequences if delays happened.

The Outcome

Kestrel mailed the signed form, the issuer reversed the dispute, funds were released, and VectorSynch avoided arbitration; leadership adopted the Proposal Kit documents as standard programs to prevent future disputes, giving the company a lasting advantage across compliance, quality, and profits.

Abstract

This Chargeback Reversal Authorization is a focused tool for chargeback dispute management. It applies after an initial chargeback is filed and the merchant believes the disputed transaction was valid. The form captures the case number, transaction date, and card network (Visa, Mastercard, Discover, American Express).

By signing, the cardholder agrees that the chargeback was reported in error and authorizes reversal. The merchant notes it has tracking and other transaction data and will provide a rebuttal to the issuing bank through the representment process managed with the payment processor and the merchant's acquiring bank.

Key topics align with card network rules and the standard chargeback process. The signed document constitutes compelling evidence when combined with organized evidence such as transaction receipts, delivery confirmation, invoices, order confirmation, confirmation emails, packing slips, and communication history. The merchant reserves the right to seek further investigation if a signature is not obtained.

The form must be printed and faxed or mailed; electronic delivery is not accepted. Used correctly, this form can help resolve disputes, reduce the chargeback ratio, and mitigate higher processing fees and associated fees that banks may impose for excessive formal chargebacks.

In practice, merchants use this tool to fight friendly fraud chargebacks, billing errors, and customer confusion. Supporting evidence may include address verification results, IP address verification and IP logs, device fingerprinting, card verification responses, shipping address and billing address matches, and proof that the customer accessed the goods or services. A clear refund policy, accurate records, and timely cardholder communication help provide proof and submit compelling evidence within the specified timeframe. When issuing bank reviews begin, an effective chargeback response and rebuttal letter that explains the chargeback reason and provides additional information can determine the outcome of the disputed amount.

Example use cases include high-value transactions with delivery confirmation, digital services where customers accessed content, and subscription renewals where consumers request refunds after fulfillment. Most disputes can be resolved before pre-arbitration by gathering evidence quickly, demonstrating the legitimacy of the original transaction, and showing the customer agreed to the transaction amount. This proactive strategy helps prevent future chargebacks and protects revenue and customer experience.

Proposal Kit can streamline this workflow by helping you assemble documentation, create rebuttal letters and supporting evidence packets, and maintain consistent templates. Its AI Writer can build related documents, and its line-item quoting can support operational cost and allocation details across your business forms.

Beyond confirming a chargeback was reported in error, this authorization sits inside a broader chargeback management program that protects the merchant account and reduces total costs. Key players include the buyer, issuing bank, acquirer, payment processor, and card networks. Typically, a financial institution will notify you of a chargeback claim and a time limit to respond.

The first step is to gather and submit a representment package with evidence presented to demonstrate the legitimacy of the original payment. Failure to respond can lead to automatic loss, funds returned to the cardholder, higher fees, penalties, or even termination if the chargeback rate trends upward in a given month.

Effective strategies focus on fraud prevention and clear customer communications. Use fraud prevention tools such as address verification services, velocity checks, fraud detection rules, and data analytics to identify red flags and prevent chargebacks in the first place. When fighting chargebacks, provide evidence aligned to the reason code: signed receipts, transaction details, delivery confirmation for goods delivered, invoices, order confirmation, chat logs, and records that the customer agreed, paid, and accessed the service.

Address discrepancies, clarify processing errors, and, if a mistake happened, refund directly to avoid escalation. For visa chargebacks and other card network rules, the process may include pre-arb steps, a pre-arbitration response, and, if needed, request arbitration to reach a final resolution. Distinguish fraudulent transactions and fraudulent claims from legitimate transactions, and explicitly state the key differences in your argument to create reasonable doubt against unjustified customer claims.

Operationally, challenging chargebacks is time-consuming and involves multiple parties. Implement proactive measures, establish an allocation workflow for responsibilities, and manage notifications and deadlines so you can respond on time. Decide when to appeal, when to accept, and when a forced reversal or legal action risk outweighs the benefits. Document how funds, money flows, and total costs affect liability and operations, then match evidence provided to each claim so you defend your account and win more disputes while maintaining a positive customer experience.

Proposal Kit helps you assemble organized documentation and policies, create rebuttal letters, and compile a complete representation package with the needed supporting documents. Its AI Writer can build related materials quickly, and its automated line-item quoting clarifies operational costs and allocations. The extensive template library makes it easier to establish consistent practices that align with your website checkout, customer contacts, and compliance needs, helping you protect revenue and improve your win rate without adding unnecessary complexity.

Expanding on the broader dispute process, this authorization functions as a targeted, first-line tool once you receive notification of payment disputes or customer disputes that were initiated in error. To avoid delays and ratio impacts, verify the validity of the claim immediately and have the authorized cardholder sign the form; do not sign on their behalf. If the customer is unable or unwilling to sign, escalate using organized evidence rather than submitting an invalid filing.

Use chargeback alerts to shorten the timeline and stay current on card network enforcement and deadlines so you do not miss the point at which a pre-arb challenge becomes impossible. For high-risk transactions, investing in integrated systems and fraud prevention programs is crucial: combine industry data, fraud detection, and data analytics to identify the leading cause of disputes and prevent future disputes.

With limited resources, prioritize cases by disputed amount, reason code, and business impact. Build a collaboration workflow across operations, finance, and customer service to gather relevant documentation, quickly signed receipts, transaction details, delivery proof, and customer communications, and provide compelling evidence plus additional evidence as needed. Explicitly explain the nature of complaints, clarify restrictions (such as fax/mail-only submission), and answer concerns to reduce cancellations and refunds.

If an unauthorized use is confirmed, accept responsibility and refund directly rather than attempt a forced reversal. Merchants who report excessive chargebacks can face penalties, audits, higher fees, and even termination; ignoring deadlines can cause you to lose funds and profits automatically.

Quality documentation is important for success. Clearly identify the legal entity on the form, match details to the account records, and demonstrate the truth and legitimacy of what happened. Proposal Kit gives businesses an advantage by helping establish consistent documentation practices, assemble dispute packets efficiently, and manage an allocation workflow of responsibilities. Its document assembly, AI-driven writing assistance, and line-item quoting support help you implement effective, compliant processes that protect money, reduce total costs, and improve resolution outcomes.

How do you write a Chargeback Reversal Agreement (Stronger) document? - The Narrative

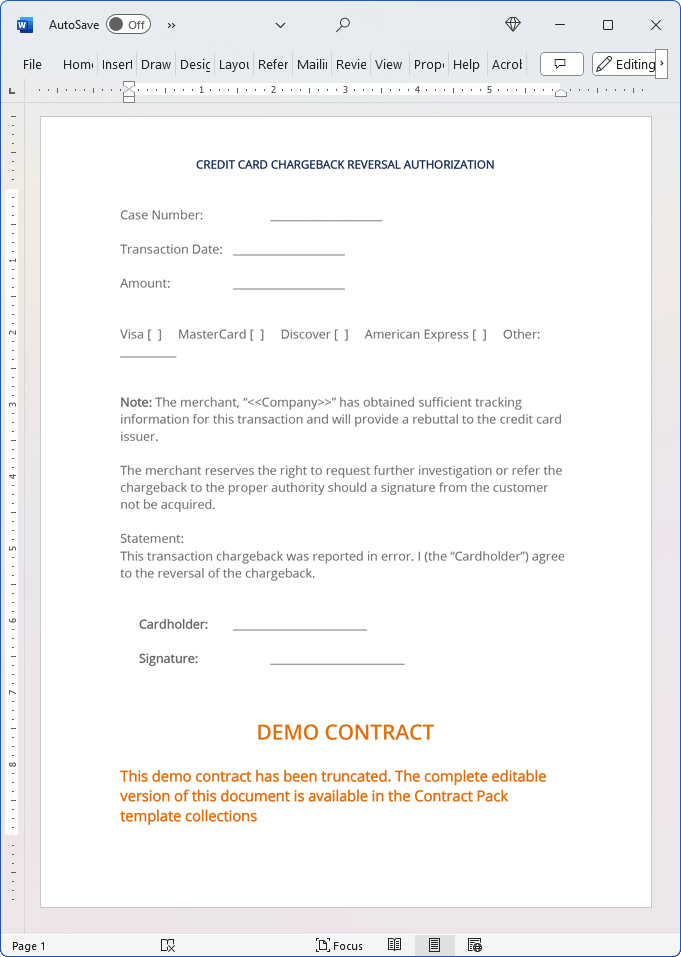

CREDIT CARD CHARGEBACK REVERSAL AUTHORIZATION.

Case Number:

Transaction Date:

Visa [ ] MasterCard [ ] Discover [ ] American Express [ ] Other:

Note: The merchant, "Company Name" has obtained sufficient tracking information for this transaction and will provide a rebuttal to the credit card issuer. The merchant reserves the right to request further investigation or refer the chargeback to the proper authority should a signature from the customer not be acquired. This transaction chargeback was reported in error. I (the "Cardholder") agree to the reversal of the chargeback.

Print and Fax this form to:

Company Name Attention: Sales Dept - Fax Fax Number.

Print and mail this form to:

Company Name

City, State Postal Code

Important: Email, Adobe PDF, Email Faxes or other Electronic delivery of this form will NOT be accepted.

20% Off Discount

![]() Add To Cart This Word Template Only

Add To Cart This Word Template Only

Add To Cart IT/Software/Hardware Contract Pack

Add To Cart IT/Software/Hardware Contract Pack

Add To Cart Proposal Kit Professional Bundle

Add To Cart Proposal Kit Professional Bundle

4.7 stars, based on 849 reviews

4.7 stars, based on 849 reviewsAlternate Documents

How to Build a Legal Contract with Proposal Kit

This video illustrates how to create a legal contract using the Proposal Pack Wizard software. It also shows how to create a proposal with an invoice and contract at the same time.

Frequently Asked Questions

How do I customize this contract to fit my business needs?

Customizing this contract involves editing the document to include your business details, terms, and conditions. The templates are designed to be flexible, allowing you to insert your company's name, address, and other relevant information. You can modify clauses to reflect your unique business practices and legal requirements.

Is this contract compliant with laws and regulations?

The legal contract templates are written by legal professionals and designed to comply with current laws and regulations at the time of their writing. However, laws can vary by jurisdiction and change over time, so it's recommended to have your contract reviewed by a local attorney to ensure it meets all legal requirements specific to your region and industry. Templates are licensed as self-help information and not as legal advice.

Can I use the same contract for different clients or projects?

You can use the same contract for different clients or projects. The templates are versatile and easily adapted for various scenarios. You will need to update specific details such as client names, project descriptions, and any unique terms for each new agreement to ensure that each contract accurately reflects the particulars of the individual client or project.

What should I do if I encounter a clause or term I don't understand?

If you encounter a clause or term in the contract that you need help understanding, you can refer to guidance notes explaining each section's purpose and use. For more complex or unclear terms, it's advisable to consult with a legal professional who can explain the clause and help you determine if any modifications are necessary to suit your specific needs.

How do I ensure that the contract is legally binding and enforceable?

To ensure that the contract is legally binding and enforceable, follow these steps:

- Complete all relevant sections: Make sure all blanks are filled in with accurate information.

- Include all necessary terms and conditions: Ensure that all essential elements, such as payment terms, deliverables, timelines, and responsibilities, are clearly defined.

- Signatures: Both parties must sign the contract, and it is often recommended that the contract be witnessed or notarized, depending on the legal requirements in your jurisdiction.

- Consult a legal professional: Before finalizing the contract, have it reviewed by an attorney to ensure it complies with applicable laws and protects your interests.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.By Ian Lauder

Published by Proposal Kit, Inc.

Published by Proposal Kit, Inc.Disclaimers

Proposal Kit, Inc. makes no warranty and accepts no responsibility for the suitability of any materials to the licensee's business. Proposal Kit, Inc. assumes no responsibility or liability for errors or inaccuracies. Licensee accepts all responsibility for the results obtained. The information included is not legal advice. Names in use cases have been fictionalized. Your use of the contract template and any purchased packages constitutes acceptance and understanding of these disclaimers and terms and conditions.

Cart

Cart

Get 20% off ordering today:

Get 20% off ordering today:

Facebook

Facebook YouTube

YouTube Bluesky

Bluesky Search Site

Search Site