How to write your Expense Report

We include this 1 page template with IT/Software/Hardware Contract Pack and the Proposal Kit Professional. You will get more content and software automation for data merging, managing client documents, and creating proposals with line item quoting with a Contract Pack or the Professional.

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES What Our Clients Say

What Our Clients SayYour products have provided me with a great basis to construct a workflow for my web design clients, especially as you have them comply with Australian laws. As a freelancer, I cannot afford to hire a solicitor to write my contracts so using yours has saved me a lot of time and money."

WEBLINEDESIGN

1. Get IT/Software/Hardware Contract Pack or the single template that includes this business contract document.

We include this contract in editable Excel format that can be customized using your office software.

2. Download and install after ordering.

Once you have ordered and downloaded your template or pack, you will have all the content you need to get started.

3. Customize the contract template with your information.

You can customize the contract document as much as you need. If you get a Contract Pack or Professional Bundle, you can also use the included Wizard software to automate name/address data merging.

Use cases for this template

BlueMesa Robotics tames nonbillable project travel and currency confusion

The Challenge

As BlueMesa Robotics expanded a pilot project in Toronto, CFO Jenna Park watched engineers submit scattered nonbillable travel forms with missing exchange rates and unclear business purpose notes, leading to delayed approvals, unhappy employees waiting for reimbursement, and a looming board review where investors wanted proof that total expenses and spending patterns were under control.

The Solution

BlueMesa adopted the simple contract form to centralize activity, project, signatures, and approvals, then used Proposal Kit to create the supporting playbook: a rollout plan, a manager briefing, and a traveler quick-reference card; its AI Writer produced a concise currency-handling addendum and a two-page board update, while automated line-item quoting modeled budgets by cost center so managers could compare per diem versus actuals.

The Implementation

Jenna scheduled a one-hour training, attached sample receipts showing the recorded rate, and published the Proposal Kit-generated guides to a shared hub; the finance team ran a dry run on two trips, confirmed the new expense lines matched the quoting scenarios, and set a weekly cutoff so approvers could clear the queue before payroll.

The Outcome

Within a month, reimbursements arrived on time, submissions included the right exchange details, and the board memo quantified savings from fewer corrections; engineers spent less time fixing forms, managers had a clean audit trail, and forecasts aligned with line-item budgets.

Harbor & Finch Advisors turns a chaotic roadshow into clean data

The Challenge

When partners at Harbor & Finch Advisors launched a five-city client roadshow, consultant Miles Ortega used his own card for hotels and rides, then forgot to note rates on overseas receipts, leaving finance to guess totals, while a client asked for a consolidated summary to validate that expenditures were strictly nonbillable marketing.

The Solution

The firm standardized on the contract form for each trip segment and tapped Proposal Kit to create the supporting procedure manual, an FAQ for travelers, and a client-facing summary template; the AI Writer assembled a quarterly spend analysis and a brief training script, and line-item quoting let finance test caps for meals and ground transport before announcing limits.

The Implementation

Operations circulated the new documents, collected two weeks of submissions, and used the quoting scenarios to spot high-cost cities; Miles retraced receipts with currency notes, attached them to the form, and his manager approved cleanly, while the client received a Proposal Kit-generated summary showing purpose, dates, and totals by category.

The Outcome

Approval times dropped by half, consultants got reimbursed without back-and-forth, and the client renewed the retainer after seeing transparent travel summaries; partners gained reliable run-rate data, enabling smarter pricing for the next tour.

GreenSpan Watershed Trust aligns grant rules with staff travel

The Challenge

Program director Lila Mahmoud faced a grant audit window while field teams traveled to remote sites, and the trust's fragmented expense notes lacked signatures and approval dates, putting grant reimbursement at risk if reviewers could not match each entry to project activities.

The Solution

GreenSpan adopted the streamlined form to capture project, activity, and approvals, then used Proposal Kit to produce a sponsor-facing compliance memo, a board-status report, and a field logistics plan; the AI Writer drafted a short study on mileage documentation standards, and line-item quoting broke grant budgets into traceable travel, lodging, and supplies.

The Implementation

Lila briefed regional leads, distributed Proposal Kit documents in a single packet, and ran a pilot on two site visits to validate that mileage logs and receipts lined up with the quoted budget slices; finance checked completeness daily and flagged gaps before submissions went to the grantor.

The Outcome

The grantor accepted the first reimbursement package without queries, audit readiness improved with consistent signatures and dates, and the board saw clearer variance reports; field staff spent less time rewriting narratives and more time on conservation work.

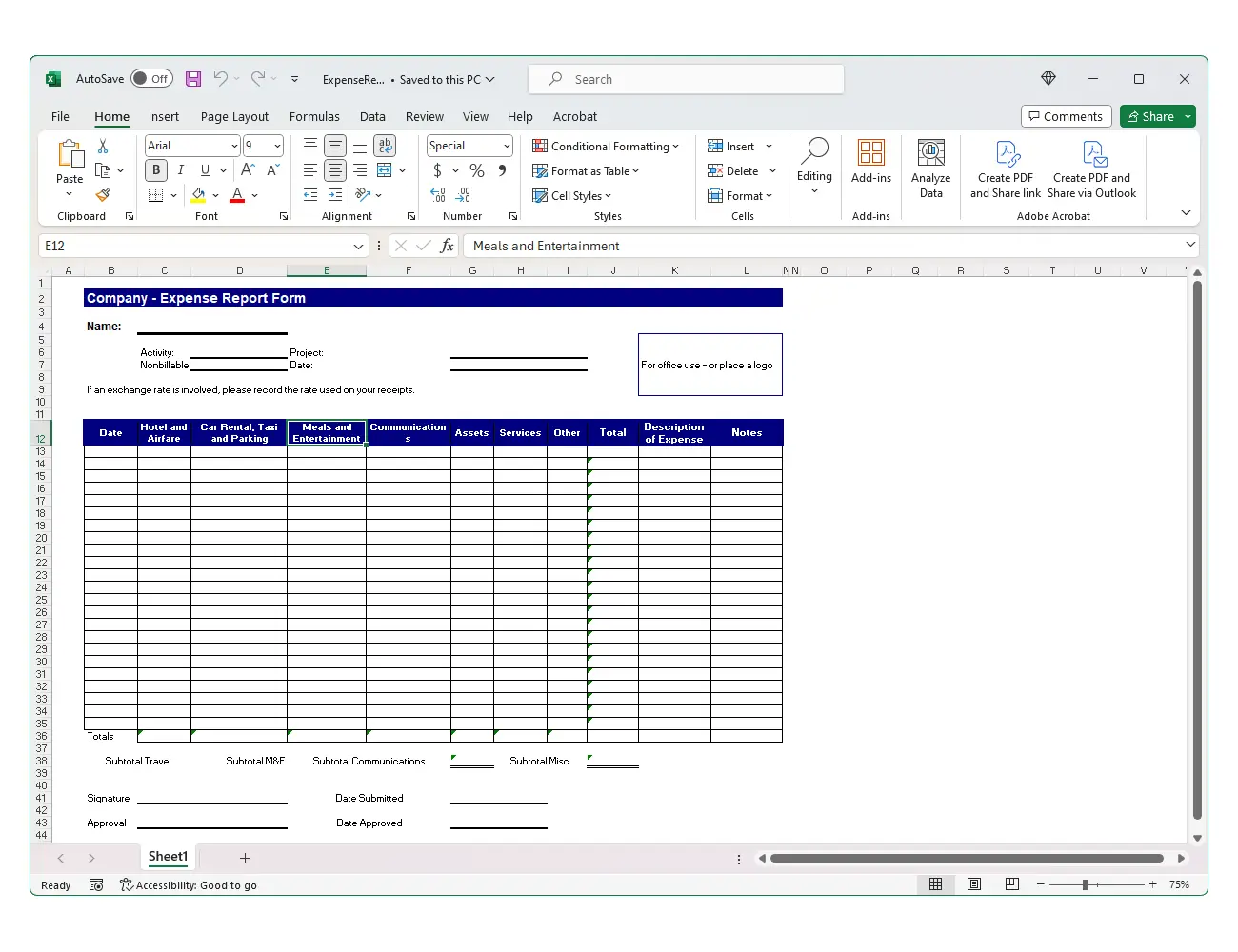

Abstract

This short form functions as a practical business tool for documenting employee expenses tied to an activity and project. It captures important details-activity, project name, nonbillable status, date submitted, approval date, and signature- so the finance team can manage expenses, ensure compliance with company policy, and maintain accurate financial records. The note about exchange rates prompts employees to record the rate used on receipts for purchases abroad, which supports tax purposes, audits, and clear documentation during tax season.

In use, employees submit the form after a business trip or routine purchases. They itemize listed expenses with a brief description, business purpose, payment method (company funds, corporate cards, or personal funds), and total amount. Typical expense categories include travel expenses (airlines, hotels, car rentals, ground transportation, parking fees), meals, lodging, office supplies, and other services.

For business mileage, include miles driven and odometer readings for mileage reimbursement. When foreign currency is involved, attach receipts showing the exchange rate to reflect actual spending. Attach relevant documentation such as invoices, other documentation, and proof of payment. A manager then completes the approval process so the reimbursement process can continue, often via direct deposit to a bank account.

This simple way to create and submit expense forms helps organizations track expenses, reduce manual data entry, and avoid manual errors. Finance can consolidate data in spreadsheets or accounting software to produce financial reports, spot spending patterns, and identify areas for savings. Small businesses and small teams benefit from clear expectations, spend limits by cost center, and the ability to flag policy concerns before they become costly. For recurring expenses, monthly reports across various categories improve visibility and support data-driven decisions, budgets, and tax deductions when applicable under tax laws.

Examples: a consultant on business travel uses the form to itemize transportation, meals, and lodging; an account manager uses a personal vehicle for client visits and records mileage; an office manager purchases supplies on a company card and summarizes card transactions by merchant and date range. Employees submit all the details, attach receipts, and the finance team approves expenses and reimburses employees for out-of-pocket costs.

Proposal Kit can help teams standardize these documents with document assembly, automated line-item quoting, an AI Writer to build supporting materials, and an extensive template library. Its ease of use supports consistent formats that simplify the entire process from submission to review.

Beyond the basics, a disciplined expense reporting process strengthens financial health and control. Using an expense report template or a monthly expense report template helps the entire team track spending by reporting period and categorize expenses across different types: travel, lodging, meals, entertainment, rent for meeting space, phone charges, procurement of inventory, and city-specific ground transportation. Employees use expense reports to separate business expenses from personal expenses, mark deductible expenses that may be tax-deductible, and ensure the detailed record includes all relevant details and key information needed for tax forms, tax returns, and potential audits by the IRS. Clear expense policies establish guidelines that are fair, reduce risk, and support informed budgeting decisions and quarterly financial reports.

To create an expense report, employees itemize each expense line with vendor, date, dollar amount, payment method (company cards, credit card, cash, or their own money), and a brief business purpose. They upload receipts and other documentation; receipt capture and receipt scanning in modern expense reporting software often use OCR technology to automate data entry, saving time and improving accuracy. Teams can track mileage for a personal vehicle, record per diem, and include expenses incurred on behalf of an employer during a period, such as a monthly expense.

Approvers review and approve expenses, reimburse employees for what is owed, and confirm the grand total matches the listed expenses. Automated software can flag policy violations or fraud, surface trends in business spending in real time, and provide valuable insights that streamline operations and help determine budgets. For recurring expense reports and monthly expense reports, having a column for expense types and space for explanations or additional information reduces delays and ensures submissions include the following information expected by managers: totals, currency used, and any request for an advance.

Proposal Kit supports this workflow by helping organizations create expense policies, training materials, and the form cover pages with consistent language and structure. Teams can use its document assembly, automated line-item quoting to align budgets and cost centers, AI Writer for examples and explanations, and an extensive template library to create expense reports, establish practices, and prepare instructions for submitting expense reports. These solutions help small and large organizations streamline documentation, match templates to company guidelines, and focus resources on higher-value tasks without changing your preferred accounting tools or mobile app stack.

Additionally, a mature expense management program defines types of expense reports tailored to the work at hand: project-based, nonbillable activity, mileage-only, per diem, and event-related, so employees know which form to use and what important details to include. This structure helps simplify expense reporting while ensuring compliance with company policy and tax rules. A signature line on the form signals that the submitter is responsible for accuracy, that all expenditures are business-related, and that totals and currency are correct. Capturing total expenses on each report and maintaining clear expense tracking logs are crucial at tax time to reconcile what was paid, what remains owed, and what may be deductible.

The difference between efficient and ad hoc practices often comes down to discipline: set cutoffs per reporting period, require itemized lines, and don't forget to attach rate information for foreign currency. For example, in one instance, a manager can compare many types of reports side by side to balance budgets, spot variance, and determine if spending aligns with guidelines. These benefits matter to executives and investors who rely on consistent data to make informed decisions. Good controls also reduce rework: approvers can quickly search the record, verify totals, and sign off when supporting proof matches policy.

This article highlights why it is crucial to capture key information the first time. Typically, submitters add brief explanations for unusual charges, note whether items were paid with personal or company funds, and provide contacts for vendors when clarification is needed. When questions arise, employees should contact the finance team early to avoid delays. A standardized approach keeps the process efficient, reduces risk, and helps the entire organization operate with confidence.

How do you write a Expense Report document? - The Narrative

Activity: Project:

Nonbillable Date: For office use - or place a logo. "If an exchange rate is involved, please record the rate used on your receipts.

Signature Date Submitted

Approval Date Approved

20% Off Discount

![]() Add To Cart This Excel Template Only

Add To Cart This Excel Template Only

Add To Cart IT/Software/Hardware Contract Pack

Add To Cart IT/Software/Hardware Contract Pack

Add To Cart Proposal Kit Professional Bundle

Add To Cart Proposal Kit Professional Bundle

4.7 stars, based on 849 reviews

4.7 stars, based on 849 reviewsRelated Documents

How to Build a Legal Contract with Proposal Kit

This video illustrates how to create a legal contract using the Proposal Pack Wizard software. It also shows how to create a proposal with an invoice and contract at the same time.

Frequently Asked Questions

How do I customize this contract to fit my business needs?

Customizing this contract involves editing the document to include your business details, terms, and conditions. The templates are designed to be flexible, allowing you to insert your company's name, address, and other relevant information. You can modify clauses to reflect your unique business practices and legal requirements.

Is this contract compliant with laws and regulations?

The legal contract templates are written by legal professionals and designed to comply with current laws and regulations at the time of their writing. However, laws can vary by jurisdiction and change over time, so it's recommended to have your contract reviewed by a local attorney to ensure it meets all legal requirements specific to your region and industry. Templates are licensed as self-help information and not as legal advice.

Can I use the same contract for different clients or projects?

You can use the same contract for different clients or projects. The templates are versatile and easily adapted for various scenarios. You will need to update specific details such as client names, project descriptions, and any unique terms for each new agreement to ensure that each contract accurately reflects the particulars of the individual client or project.

What should I do if I encounter a clause or term I don't understand?

If you encounter a clause or term in the contract that you need help understanding, you can refer to guidance notes explaining each section's purpose and use. For more complex or unclear terms, it's advisable to consult with a legal professional who can explain the clause and help you determine if any modifications are necessary to suit your specific needs.

How do I ensure that the contract is legally binding and enforceable?

To ensure that the contract is legally binding and enforceable, follow these steps:

- Complete all relevant sections: Make sure all blanks are filled in with accurate information.

- Include all necessary terms and conditions: Ensure that all essential elements, such as payment terms, deliverables, timelines, and responsibilities, are clearly defined.

- Signatures: Both parties must sign the contract, and it is often recommended that the contract be witnessed or notarized, depending on the legal requirements in your jurisdiction.

- Consult a legal professional: Before finalizing the contract, have it reviewed by an attorney to ensure it complies with applicable laws and protects your interests.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.By Ian Lauder

Published by Proposal Kit, Inc.

Published by Proposal Kit, Inc.Disclaimers

Proposal Kit, Inc. makes no warranty and accepts no responsibility for the suitability of any materials to the licensee's business. Proposal Kit, Inc. assumes no responsibility or liability for errors or inaccuracies. Licensee accepts all responsibility for the results obtained. The information included is not legal advice. Names in use cases have been fictionalized. Your use of the contract template and any purchased packages constitutes acceptance and understanding of these disclaimers and terms and conditions.

Cart

Cart

Get 20% off ordering today:

Get 20% off ordering today:

Facebook

Facebook YouTube

YouTube Bluesky

Bluesky Search Site

Search Site