How to write your Customer Business Credit Application

We include this 1 page template with Contractors Contract Pack and the Proposal Kit Professional. You will get more content and software automation for data merging, managing client documents, and creating proposals with line item quoting with a Contract Pack or the Professional.

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES What Our Clients Say

What Our Clients SayThe Contract Packs ensures I do not miss anything that will get the contract rejected for missing an item allowing me to focus on proposal."

Principal Research Scientist

Primordial Soup, LLC.

1. Get Contractors Contract Pack or the single template that includes this business contract document.

We include this contract in editable Word format that can be customized using your office software.

2. Download and install after ordering.

Once you have ordered and downloaded your template or pack, you will have all the content you need to get started.

3. Customize the contract template with your information.

You can customize the contract document as much as you need. If you get a Contract Pack or Professional Bundle, you can also use the included Wizard software to automate name/address data merging.

Use cases for this template

HarborPoint Electronics Supply launches a trade credit program for fast-growing retailers

The Challenge

Lena Ortiz, CFO at HarborPoint Electronics Supply, wanted to offer trade credit to new customers like NeonGrove Gadgets LLC without triggering bad debt or late payments, but her sales team lacked a consistent credit application process and kept asking how much credit to grant without reliable data or trade references.

The Solution

HarborPoint adopted a standardized business credit application form to collect contact details, bank information, tax ID, and credit history, and used Proposal Kit to create supporting documents: a credit policy guide, verification checklists, and a concise reference request letter, while the AI Writer produced a short onboarding explainer and a risk summary, and line-item quoting framed offers in proposals separate from the application.

The Implementation

They trained reps to present the application early, required applicants to fill out all the information and consent to a credit check, and routed files to finance for the approval process, then shared Proposal Kit-generated instructions on what to submit and when, reducing back-and-forth and improving compliance with regulatory requirements around sensitive information.

The Outcome

NeonGrove was approved for a modest line of credit with phased increases tied to on-time payment performance, approval times dropped from ten days to four, and HarborPoint made more informed decisions with fewer errors while boosting cash flow and strengthening vendor-client relationships.

Canyon Ridge Materials evaluates a contractor's capacity during peak season

The Challenge

Maya Chen at Silver Dune Builders needed materials on terms to win a municipal bid, but Canyon Ridge Materials had to determine the applicant's ability to repay amid seasonal income swings and incomplete business information that previously slowed reviews and created risk.

The Solution

Canyon Ridge required the business credit application form with bank references, trade references, and disclosures, then used Proposal Kit to assemble a verification packet, an internal legal-compliance note on data handling and regulatory requirements, and an AI Writer-generated demand forecast brief to help managers make accurate credit decisions, while line-item quoting clarified bid pricing apart from credit terms.

The Implementation

Applicants were instructed to submit the form with a date and authorization so finance could collect and process data, run a credit report, and analyze payment patterns, and sales used Proposal Kit's templates to present clear steps and timelines, ensuring access to all necessary details before approval.

The Outcome

Silver Dune received a starter line tied to project milestones, on-time payment unlocked higher limits, late payments declined across the portfolio, and Canyon Ridge reduced risk while securing repeat business during the busy season.

Orbital Path Logistics balances growth and control with structured onboarding

The Challenge

Raj Patel of Kestrel Cycle Co. sought terms for nationwide fulfillment, but Orbital Path Logistics struggled to separate sales enthusiasm from credit risk and lacked consistent documentation to support informed decisions about credit requested versus actual financial health.

The Solution

Orbital Path used the standardized application to collect tax ID, owners' details, bank information, and bankruptcy disclosures, then leveraged Proposal Kit to create a concise applicant guide, a collections communication plan, and an AI Writer-drafted operations memo explaining the credit application process, while proposals with line-item quoting detailed services and pricing independently of credit evaluation.

The Implementation

Applicants were asked to fill the form completely, provide consent for verification, and present recent references, and finance set review dates post-approval; Proposal Kit's templates ensured consistent language on how data would be used and stored, aligning with internal policies and regulatory expectations.

The Outcome

Kestrel was approved with clear payment terms and a review schedule. Orbital Path saw faster approvals, fewer documentation gaps, and stronger cash flow, and both organizations gained predictable operations with reduced administrative friction.

Abstract

This business credit application form is a concise commercial credit tool used by lenders, suppliers, and vendors to evaluate an applicant before extending credit. It asks for personal information such as a driver's license number, contact details, and disclosures about felony convictions or bankruptcy, plus bank information, including checking, savings, and other accounts, and a home equity loan balance. It also requests business references. The applicant certifies that all the information is accurate and gives authorization and consent for financial institutions to release data for verification, enabling a credit check and credit report review.

Organizations use this application process to make accurate credit decisions, determine how much credit to grant, and decide whether to offer a line of credit or trade credit terms. The approval process analyzes financial information to assess financial health, repayment ability, and risk so operations can manage accounts payable exposure, reduce bad debt, and limit late payments. For new customers and potential clients, commercial credit applications are critical to cash flow planning and to setting payment terms that match industry practices.

Typically, credit application forms collect business information, owners' details, tax ID, bank references, trade references, income indicators, assets, and sometimes collateral. This form additionally highlights sensitive information such as account numbers and a home equity loan, making security, compliance, and data protection regulations crucial. The lender uses the applicant's consent to collect and process data, verify references, and analyze the file to reach an informed decision.

At the point of approval, the lender sets the credit requested/approved line and the agreement to pay on time. Applicants generally submit the form with a date and signature, sometimes through digital workflows on a website to reduce errors and enhance verification.

Example uses include a wholesaler establishing trade credit for retailers, a construction supplier evaluating contractors, a manufacturer onboarding distributors, or a professional services firm creating terms for clients who prefer to pay by invoice.

Proposal Kit helps organizations establish and manage this documentation with document assembly, an extensive template library for credit application forms and supporting policies, automated line-item quoting for related proposals, and an AI Writer to create consistent supporting documents. These capabilities help create clear forms, improve compliance, and reduce errors while keeping the process easy to use.

In practice, reviewers look at the applicant's credit history alongside bank and business references to see repayment patterns and current obligations. A disciplined credit application process helps lenders separate business needs from personal loans and set terms that fit the applicant's ability to repay. Applicants should present concise business information and fill the form completely, since missing data slows verification and can limit how much credit is approved.

Authorization in the form creates a legal basis for a credit check and access to third-party financial information, supporting informed decisions while aligning with regulatory requirements on sensitive information. The benefits flow both ways: vendors reduce risk and bad debt, and clients gain predictable trade credit that supports cash flow.

For example, a regional distributor may screen new retail accounts, weighing credit history trends and seasonality before granting a line of credit. A contractor applying for materials on terms can present recent bank information to demonstrate the capacity to repay within the agreed payment periods. Management can also tune policies for higher-risk profiles, such as prior bankruptcies, without denying all access to needed supplies.

Proposal Kit can streamline how organizations create and manage these documents. Teams can assemble clear, consistent application forms, include appropriate authorization language, and tailor questionnaires to industry norms. The template library, automated line-item quoting for related proposals, and the AI Writer help produce coherent supporting documents that make the process easier to understand and use.

Beyond initial screening, many organizations set review cycles to revisit each approved line of credit. They compare the latest credit report, bank information, and, when provided, income summaries or tax filings to confirm financial health and determine whether to adjust limits. Conditional approvals are common: higher-risk applicants may receive smaller lines, shorter payment terms, or be asked for collateral tied to specific assets. Clear documentation of these decisions on the form, with a date, ensures audit readiness and supports legal defensibility.

Effective governance separates sales from credit review, so accurate credit decisions are not influenced by quotas. Accounting teams analyze trends in late payments and bad debt by industry segment to tune policies. They also standardize verification steps for bank and trade references so teams collect all the information needed to make informed decisions. Storing sensitive information with limited access and defined retention periods helps maintain compliance with regulatory requirements without slowing operations.

Applicants benefit when instructions explain how to fill out the application and which contact details, owners' information, tax ID, and business references are typically required. Clear prompts about the credit requested, intended use of services or supplies, and ability to repay speed the approval process. Where personal loans or prior bankruptcies exist, applicants can present context proactively to reduce follow-up. Additionally, pre-screen questions on a website can route higher-risk profiles to manual review, while straightforward cases move through digital workflows faster.

Proposal Kit can help teams create consistent, professional documents for this credit application process. Its document assembly and template library make it easier to present authorization language, privacy notices, and reference request letters alongside the core form. The AI Writer can write related policies and instructions, while automated line-item quoting lets suppliers package credit terms with proposals. These tools help organizations reduce errors and communicate expectations clearly.

How to write my Customer Business Credit Application document - The Narrative

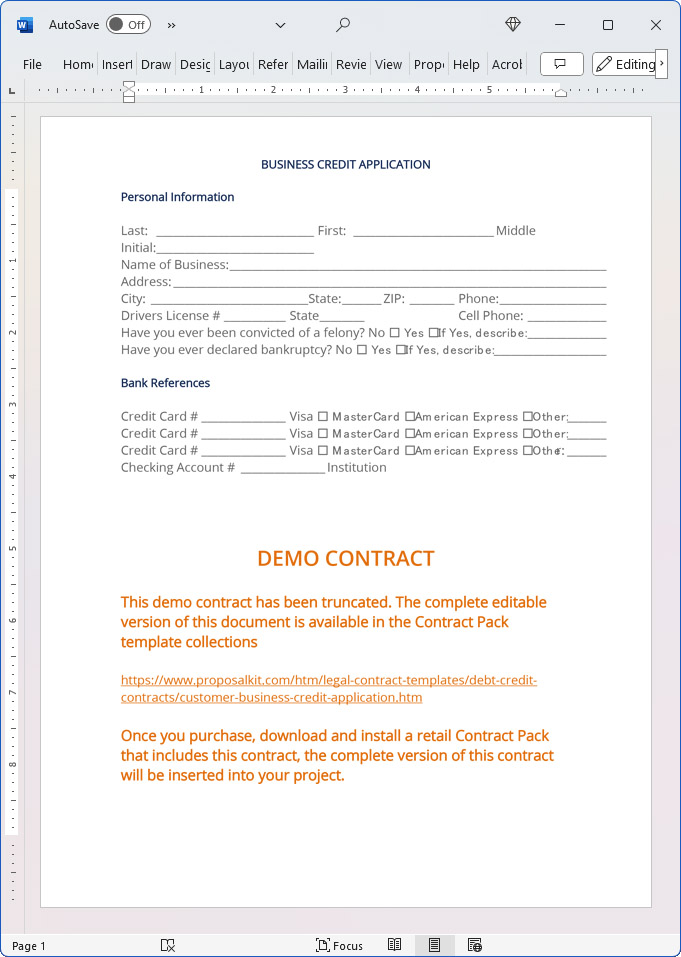

BUSINESS CREDIT APPLICATION

Personal Information

Name of Business:

Drivers License # State Cell Phone:

Have you ever been convicted of a felony? No ? Yes ? If Yes, describe:

Have you ever declared bankruptcy? No ? Yes ? If Yes, describe:

Bank References

Credit Card # Visa ? MasterCard ? American Express ? Other:

Checking Account # Institution Name:

Address Phone

Savings Account # Institution Name:

Address Phone

Other Account # Institution Name:

Address Phone

Home Equity Loan #: Loan Balance: Institution Name.

Business References

I hereby certify that the information supplied above is complete and accurate. I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

20% Off Discount

![]() Add To Cart This Word Template Only

Add To Cart This Word Template Only

Add To Cart Contractors Contract Pack

Add To Cart Contractors Contract Pack

Add To Cart Proposal Kit Professional Bundle

Add To Cart Proposal Kit Professional Bundle

4.7 stars, based on 849 reviews

4.7 stars, based on 849 reviewsAlternate Documents

Related Documents

How to Build a Legal Contract with Proposal Kit

This video illustrates how to create a legal contract using the Proposal Pack Wizard software. It also shows how to create a proposal with an invoice and contract at the same time.

Frequently Asked Questions

How do I customize this contract to fit my business needs?

Customizing this contract involves editing the document to include your business details, terms, and conditions. The templates are designed to be flexible, allowing you to insert your company's name, address, and other relevant information. You can modify clauses to reflect your unique business practices and legal requirements.

Is this contract compliant with laws and regulations?

The legal contract templates are written by legal professionals and designed to comply with current laws and regulations at the time of their writing. However, laws can vary by jurisdiction and change over time, so it's recommended to have your contract reviewed by a local attorney to ensure it meets all legal requirements specific to your region and industry. Templates are licensed as self-help information and not as legal advice.

Can I use the same contract for different clients or projects?

You can use the same contract for different clients or projects. The templates are versatile and easily adapted for various scenarios. You will need to update specific details such as client names, project descriptions, and any unique terms for each new agreement to ensure that each contract accurately reflects the particulars of the individual client or project.

What should I do if I encounter a clause or term I don't understand?

If you encounter a clause or term in the contract that you need help understanding, you can refer to guidance notes explaining each section's purpose and use. For more complex or unclear terms, it's advisable to consult with a legal professional who can explain the clause and help you determine if any modifications are necessary to suit your specific needs.

How do I ensure that the contract is legally binding and enforceable?

To ensure that the contract is legally binding and enforceable, follow these steps:

- Complete all relevant sections: Make sure all blanks are filled in with accurate information.

- Include all necessary terms and conditions: Ensure that all essential elements, such as payment terms, deliverables, timelines, and responsibilities, are clearly defined.

- Signatures: Both parties must sign the contract, and it is often recommended that the contract be witnessed or notarized, depending on the legal requirements in your jurisdiction.

- Consult a legal professional: Before finalizing the contract, have it reviewed by an attorney to ensure it complies with applicable laws and protects your interests.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.By Ian Lauder

Published by Proposal Kit, Inc.

Published by Proposal Kit, Inc.Disclaimers

Proposal Kit, Inc. makes no warranty and accepts no responsibility for the suitability of any materials to the licensee's business. Proposal Kit, Inc. assumes no responsibility or liability for errors or inaccuracies. Licensee accepts all responsibility for the results obtained. The information included is not legal advice. Names in use cases have been fictionalized. Your use of the contract template and any purchased packages constitutes acceptance and understanding of these disclaimers and terms and conditions.

Cart

Cart

Get 20% off ordering today:

Get 20% off ordering today:

Facebook

Facebook YouTube

YouTube Bluesky

Bluesky Search Site

Search Site