How to write your Extending Credit to Client Application

We include this 3 page template with Contractors Contract Pack and the Proposal Kit Professional. You will get more content and software automation for data merging, managing client documents, and creating proposals with line item quoting with a Contract Pack or the Professional.

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES

DOWNLOADABLE, ONE-TIME COST, NO SUBSCRIPTION FEES What Our Clients Say

What Our Clients SayWithout you guys I would have lost countless site agreements."

Antrim Computer Services

1. Get Contractors Contract Pack or the single template that includes this business contract document.

We include this contract in editable Word format that can be customized using your office software.

2. Download and install after ordering.

Once you have ordered and downloaded your template or pack, you will have all the content you need to get started.

3. Customize the contract template with your information.

You can customize the contract document as much as you need. If you get a Contract Pack or Professional Bundle, you can also use the included Wizard software to automate name/address data merging.

Use cases for this template

Cascade Industrial Supplies steadies cash flow while opening credit for Harbor Tech

The Challenge

When Harbor Tech Fabrication asked for Net 60 on a large tooling order, Cascade Industrial Supplies, LLC needed a way to determine creditworthiness, verify tax-exempt status, and keep accounts receivable predictable without discouraging a promising new buyer.

The Solution

Cascade used the credit application contract to capture officers, banking references, PO requirements, and acceptance of a 1.5% monthly late charge, then relied on Proposal Kit to create supporting documents-a concise credit policy memo, an onboarding checklist, and a pricing proposal with automated line-item quoting for the staged delivery schedule.

The Implementation

While the legal contract stood on its own, Proposal Kit's AI Writer drafted a short risk assessment and a cash flow impact report for management review, and the document assembly tools produced a welcome packet explaining procedures so customers understand who may order, receive, and pay.

The Outcome

Cascade approved a limited credit limit, shipped the first tranche on time, and saw timely pay behavior; the clear provision for late charges was never triggered, sales grew quarter over quarter, and the team maintained financial stability with disciplined documentation.

Brightfield Solar balances growth and risk with a sole proprietorship buyer

The Challenge

A fast-growing startup, Brightfield Solar Co., received a rush request from Mesa County Builders, a sole proprietorship, but worried a mistake in authorization or billing could slow cash and create debt it would need to pursue.

The Solution

Brightfield required the completed credit application with named authorized buyers, COD for the first order, and Net 30 after review, then used the Proposal Kit to assemble a customer onboarding guide, a collections escalation plan for contingencies, and a technical proposal using line-item quoting to spell out components, freight, and installation accessories.

The Implementation

The AI Writer produced a brief compliance and procedures guide for the sales team, outlining how to verify references and tax certificates and how to proceed when limits are reached, while the template library generated a simple delivery acknowledgment form tied back to the contract.

The Outcome

The first job funded on COD, subsequent jobs moved to Net 30 with no late payments, and Brightfield expanded the account responsibly, preserving cash flow while earning repeat business and strong references.

BlueRiver Foods streamlines multi-location credit for GreenLeaf Grocer Cooperative

The Challenge

BlueRiver Foods needed to extend limited credit to GreenLeaf's five stores, each with different department numbers and buyers, and to keep tax-exempt documentation current while preventing delivery disputes.

The Solution

Using the credit application to assign account numbers, list authorized receivers, and confirm acceptance of terms, BlueRiver leveraged the Proposal Kit to create a multi-location SOP, a training brief for store managers, and seasonal order proposals generated with automated line-item quoting.

The Implementation

AI Writer developed a quarterly credit review report and a benefits analysis illustrating how purchase orders and three-way matching reduce errors, while document assembly produced reminder notices and a concise FAQ to help locations comply with procedures without extra support calls.

The Outcome

Invoices matched deliveries cleanly, cash was collected on schedule, no penalties accrued, and BlueRiver increased volume with the cooperative while keeping risk limited and records audit-ready.

Abstract

Extending trade credit can boost sales, but it demands a clear policy that protects cash flow and financial stability. This credit application sets out practical procedures for offering credit while managing accounts receivable. It helps the seller determine creditworthiness, verify key facts, and ensure customers understand their responsibility to pay on time.

Applicants provide business identity and structure-sole proprietorship, partnership, corporation, or limited liability company-plus officers, years in business, DUNS, and SIC. Recording the billing address, location, and tax-exempt documentation supports compliance with state laws and helps maintain security and reputation. The form gathers accounts payable contacts, whether a purchase order is required, and the names authorized to order, receive, or pick up goods, reducing delivery mistakes and discouraging unauthorized buyers.

Banking information and trade references allow the seller to verify payment history and assess creditors and debt exposure. The attestation in writing confirms the applicant's ability and willingness to pay under COD, Net 30, Net 60, or Net 90 terms. A 1.5% per month late charge functions as an interest rate, creating penalties that deter late payments. Taxes, tariffs, or other levies apply unless the buyer provides valid resale or exemption certificates. All new customers or new orders are prepaid, and credit review takes 3-5 business days. Limited, sensible steps that help collect money and fund operations.

These provisions are beneficial in dealing with customer defaults and the risks of debt collection. By defining who may place orders, the seller can better control fulfillment and proceed with confidence. The credit review and verification reduce concern about the debtor's capacity to pay and provide the advantage of consistent management procedures. Some companies also obtain a separate guarantee if their industry risk is high; this form's core provisions already help determine and monitor creditworthiness.

Example use cases include wholesalers extending Net 30 to most customers, manufacturers granting limited terms to new buyers while they build a track record, and a service firm that needs cash on the first place job but moves to Net 60 after proven performance. Each scenario can generate sales without sacrificing control.

Proposal Kit can assist by assembling this application and related policies, producing automated line-item quoting, and using its AI Writer and template library to build supporting documents. Its ease of use helps businesses maintain consistent paperwork across locations and teams.

For leaders running their own business, this application clarifies who is responsible for orders, receipt, and payment, reducing the chance of a mistake at delivery or invoicing. The late-charge provision functions much like interest rates and is designed to discourage customers from stretching terms, provided you comply with applicable state laws and internal policies. Requiring prepaid balances for first-time buyers and verifying bank and trade references are practical benefits that protect cash flow while still supporting growth.

When an account becomes past due, the documented contacts, references, and chosen terms make it easier to assess risk before proceeding to pursue collection. Clear records help management determine whether to extend additional credit, pause delivery, or escalate under standard procedures. The form also supports tax compliance by recording exemption details, which helps avoid penalties and ensures both seller and buyer have the resources needed to resolve questions quickly.

Use cases include a regional distributor that onboards new buyers with COD, then moves to Net 30 after solid payment history, and a contractor that allows limited terms but uses the late-charge provision to discourage customers from deprioritizing invoices. Both approaches balance sales with prudent accounts receivable management.

Proposal Kit can provide practical assistance by assembling this credit application with related provisions, such as a concise credit policy, onboarding procedures, and reminder templates. Its automated line-item quoting, AI Writer for building supporting documents, and extensive template library help teams generate consistent paperwork fast, so companies can pursue growth while maintaining discipline and compliance.

Beyond basic onboarding, this application helps management align credit practices with cash conversion goals. Capturing DUNS, SIC, years in business, and the credit limit requested lets the seller determine creditworthiness, set a limited opening cap, and expand terms only after a solid payment track record. Assigned customer account numbers, department or group numbers, and the account representative fields make it easier to segment buyers, track accounts receivable aging, and evaluate sales performance without losing control of cash.

The authorization sections and job titles create an internal control trail. Listing who may order, receive, or pick up goods reduces fraud risk and delivery errors. Requiring purchase orders supports three-way match procedures so customers understand what was ordered, delivered, and invoiced. These controls protect money already earned and help collect cash in the first place.

The stated 1.5% monthly late charge is a clear provision that functions like interest; paired with COD, Net 30, Net 60, or Net 90 terms, it signals expectations that discourage customers from late payments. Recording tax-exempt numbers and states ensures records comply with state laws, which reduces penalties and preserves reputation. For higher-risk industries, sellers may also monitor references and banking details more closely to verify stability and avoid customer defaults.

Operationally, the 3-5 business day review sets a practical service level. Most customers can be routed through a standard check, while exceptions remain limited until more data is available. If an account turns delinquent, the consolidated file contacts, terms, and references help the seller evaluate options before proceeding to pause delivery or pursue debt collection. This reduces concern, keeps resources focused, and is beneficial to both creditor and debtor by providing clarity in writing.

Use cases include a wholesaler onboarding a sole proprietorship with COD before moving to Net 30, a manufacturer serving a limited liability company with a small initial limit, and a service provider that uses purchase orders to avoid a billing mistake. Each example shows how offering credit can generate sales while remaining responsible and secure.

Proposal Kit can streamline this work by assembling consistent credit applications and related policies, producing automated line-item quoting, and using its AI Writer and template library to create supporting checklists and procedures. Its ease of use helps teams maintain disciplined documentation across locations and roles.

How do you write a Extending Credit to Client Application document? - The Narrative

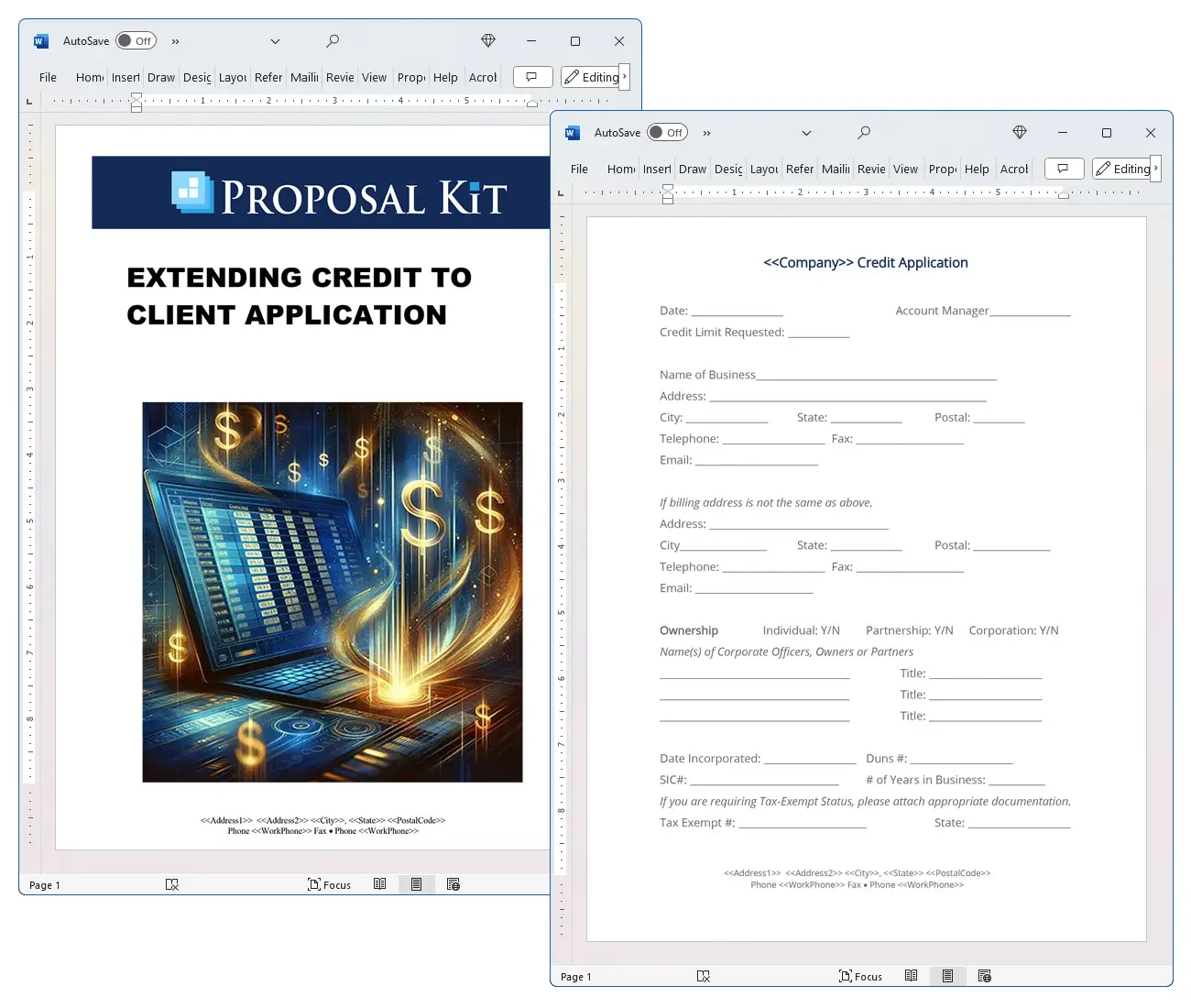

Date: Account Manager

Credit Limit Requested:

Name of Business

Telephone: Fax:

If billing address is not the same as above. Ownership Individual: Y/N Partnership: Y/N Corporation: Y/N. Name(s) of Corporate Officers, Owners or Partners.

Job title of signator, authorized signature or signer.

Date Incorporated: Duns #:

SIC#: # of Years in Business:

If you are requiring Tax-Exempt Status, please attach appropriate documentation.

Tax Exempt #: State:

Accounts Payable

Name: Telephone:

Will a purchase order be required: Y/N. Please list names of individuals, agents or employees authorized to order, receive or pick up products and materials. Job title of signator, authorized signature or signer.

Trade References:

Banking Information:

Type of Account: Savings: Y/N Checking: Y/N Credit: Y/N.

Institution Name: Account #:

Address: Contact:

City: Job title of signator, authorized signature or signer.

State, Postal: Telephone:

I, the undersigned, do hereby attest to the financial responsibility, ability and willingness to pay our invoices in a timely manner and in accordance with the Net terms circled below. I understand that a 1.5% per month late charge may be applied to any outstanding or overdue balance owed Company Name. Signature: Job title of signator, authorized signature or signer.

For all new customers or new orders, all balances must be prepaid in full. For orders made subject to a credit application, please allow for 3 - 5 business days for processing and review. All credit terms offered are subject to a verification of the application information and the customer's credit history and references.

All customers will be subject to any taxes, tariffs or other levies imposed upon goods and services as required by State or Federal law unless proper resale or exemption documentation is presented to the Company.

Assigned Customer Account Number:

Assigned By signator, authorized signature or signer

Date:

Account Payment Terms: (Circle One) COD / Net 30 Days / Net 60 Days / Net 90 Days.

Account Representative Assigned to Customer : Phone Number:

Department or Group Number:

20% Off Discount

![]() Add To Cart This Word Template Only

Add To Cart This Word Template Only

Add To Cart Contractors Contract Pack

Add To Cart Contractors Contract Pack

Add To Cart Proposal Kit Professional Bundle

Add To Cart Proposal Kit Professional Bundle

4.7 stars, based on 849 reviews

4.7 stars, based on 849 reviewsAlternate Documents

Related Documents

How to Build a Legal Contract with Proposal Kit

This video illustrates how to create a legal contract using the Proposal Pack Wizard software. It also shows how to create a proposal with an invoice and contract at the same time.

Frequently Asked Questions

How do I customize this contract to fit my business needs?

Customizing this contract involves editing the document to include your business details, terms, and conditions. The templates are designed to be flexible, allowing you to insert your company's name, address, and other relevant information. You can modify clauses to reflect your unique business practices and legal requirements.

Is this contract compliant with laws and regulations?

The legal contract templates are written by legal professionals and designed to comply with current laws and regulations at the time of their writing. However, laws can vary by jurisdiction and change over time, so it's recommended to have your contract reviewed by a local attorney to ensure it meets all legal requirements specific to your region and industry. Templates are licensed as self-help information and not as legal advice.

Can I use the same contract for different clients or projects?

You can use the same contract for different clients or projects. The templates are versatile and easily adapted for various scenarios. You will need to update specific details such as client names, project descriptions, and any unique terms for each new agreement to ensure that each contract accurately reflects the particulars of the individual client or project.

What should I do if I encounter a clause or term I don't understand?

If you encounter a clause or term in the contract that you need help understanding, you can refer to guidance notes explaining each section's purpose and use. For more complex or unclear terms, it's advisable to consult with a legal professional who can explain the clause and help you determine if any modifications are necessary to suit your specific needs.

How do I ensure that the contract is legally binding and enforceable?

To ensure that the contract is legally binding and enforceable, follow these steps:

- Complete all relevant sections: Make sure all blanks are filled in with accurate information.

- Include all necessary terms and conditions: Ensure that all essential elements, such as payment terms, deliverables, timelines, and responsibilities, are clearly defined.

- Signatures: Both parties must sign the contract, and it is often recommended that the contract be witnessed or notarized, depending on the legal requirements in your jurisdiction.

- Consult a legal professional: Before finalizing the contract, have it reviewed by an attorney to ensure it complies with applicable laws and protects your interests.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.

Ian Lauder has been helping businesses write their proposals and contracts for two decades. Ian is the owner and founder of Proposal Kit, one of the original sources of business proposal and contract software products started in 1997.By Ian Lauder

Published by Proposal Kit, Inc.

Published by Proposal Kit, Inc.Disclaimers

Proposal Kit, Inc. makes no warranty and accepts no responsibility for the suitability of any materials to the licensee's business. Proposal Kit, Inc. assumes no responsibility or liability for errors or inaccuracies. Licensee accepts all responsibility for the results obtained. The information included is not legal advice. Names in use cases have been fictionalized. Your use of the contract template and any purchased packages constitutes acceptance and understanding of these disclaimers and terms and conditions.

Cart

Cart

Get 20% off ordering today:

Get 20% off ordering today:

Facebook

Facebook YouTube

YouTube Bluesky

Bluesky Search Site

Search Site